What accounts cannot be seized by bailiffs. Can an individual entrepreneur's account be seized for utility debts? Can bailiffs seize an individual entrepreneur's account?

Entrepreneurs are often interested in the question: can bailiffs seize the current account of an individual entrepreneur? Seizure of the current account of an individual entrepreneur is an extreme measure used to fully repay the debt amount. This can occur for various reasons. Most often, government bodies use a similar instrument of influence in relation to individual entrepreneurs who have incurred various types of debts on mandatory payments to the budget. In second place are lawsuits from business partners of the entrepreneur or government agencies.

Legal grounds

Domestic legislation provides for an exhaustive list of government agencies with the right to block the current account of an individual entrepreneur:

- Federal Service for Financial Monitoring (FSFM) – its attention may be drawn to an entrepreneur who is suspected of money laundering. Another reason for federal attention may be suspicion of terrorist financing.

- Investigative authorities - in the framework of criminal or administrative cases under investigation, the property of a suspect or accused may be seized.

- Arbitration court - in order to ensure the property component of the claim filed against the individual entrepreneur. Courts of general jurisdiction have similar powers.

- Bailiffs – as part of the execution of a court decision.

- Federal Tax Service is the option that occurs most often.

Regardless of who seized the account, the individual entrepreneur must remember an important legal nuance. Only the authority by whose decision it was imposed can lift the arrest. It is useless to contact the bank with such a request. The financial institution is engaged only in servicing the current account and does not have the authority to refuse government authorities when they carry out legal procedural actions.

Regardless of who seized the account, the individual entrepreneur must remember an important legal nuance. Only the authority by whose decision it was imposed can lift the arrest. It is useless to contact the bank with such a request. The financial institution is engaged only in servicing the current account and does not have the authority to refuse government authorities when they carry out legal procedural actions.

Return to contents

Why might this happen

Experience in conducting financial and economic activities suggests that arrest is most often imposed by the tax service. The reason for this could be the following:

- failure to comply with the deadline for submitting the declaration - if it is exceeded by 10 days or more;

- untimely or incomplete payment of the accrued tax, fine or penalty - if the specified period is exceeded by 8 days or more;

- other procedural violations.

When blocking or arrest is carried out, the entrepreneur receives a corresponding notification.

In order to lift the arrest, it is necessary to fulfill the requirements of the tax authority in a short time.

If we are talking about late filing of the declaration, then you should personally appear to the inspector.

It happens that a declaration sent on the last day allotted for this purpose takes a long time due to the fault of the post office. In this case, it is enough to simply show the tax inspector the postal receipt. The Tax Code provides that the date of filing a return by mail is the day on which it was sent. If a valid term is indicated on the receipt, the arrest will be lifted.

It is more difficult when the arrest is imposed due to late payments. First, you need to transfer the required amount to the budget. After this, you must visit your tax inspector. The legislation provides for the accrual of penalties and fines for each day of delay. It is possible that after the individual entrepreneur fulfills all the requirements of the tax inspectorate, he will have to pay extra.

Return to contents

Ensuring compliance with court decisions

Can bailiffs seize the current account of an individual entrepreneur? Russian legislation gives them this right. They can act either on their own behalf or with a decision of a judicial authority in their hands. Here it is necessary to clearly understand the difference between the 2 options for the performers. For example, an individual entrepreneur is obligated to pay the plaintiff a certain amount. If this does not happen voluntarily, the bailiff seizes the debtor's property.

You can only withdraw it when you pay off the debt amount. If the defendant is still in no hurry to comply with the court decision, then the current account is seized to unconditionally write off the amount of the debt. Compliance with the legal requirements of the judicial authorities will avoid unpleasant consequences. In some cases, lifting the arrest may take up to 2-3 days, so it is better to execute the court decision yourself.

Return to contents

Special cases of application of legislation

Can individual entrepreneurs' current accounts be frozen for a long time? Yes, this happens when the Federal Service for Financial Monitoring (FSFM) or the Investigative Committee intervenes in the case. An entrepreneur against whom a criminal case has been initiated or there is reasonable suspicion of illegal activity risks saying goodbye to his funds for a long time. The minimum period for seizing an account is 10 days, and the maximum is unlimited.

Legal practice suggests that arrest can be imposed in whole or in part. For example, a government agency suspects that all funds in the account were obtained as a result of illegal activities. Then the entire amount is seized. Otherwise, part of the funds, the legality of the origin of which the state body doubts, is subject to seizure.

Such disputes must be resolved only with the help of qualified legal assistance. If the individual entrepreneur really has nothing to do with illegal activities, then during the proceedings all questions will be removed.

The arrest is canceled within 24 hours from the moment the criminal or administrative prosecution is terminated.

Russian legislation provides for the possibility of creating artificial barriers in the activities of business structures or in the event that these organizations violate the norms of laws or agreements with business partners. One of the ways of influence is arrest.

What is seizure of a current account?

The seizure of the current account of an enterprise or individual entrepreneur is one of the problematic situations in business, which it is advisable to avoid, since the inability to pay suppliers can lead to a complete stop in the activities of the company or individual entrepreneur.

Concept a Resetting your current account is given in this video:

Concept and types

Seizure of an account is the blocking of an account in order to prevent a decrease in the balance of funds in the company’s account by prohibiting any transactions on it. The main purposes of seizure:

- ensuring the fulfillment of obligations of an individual entrepreneur under credit and tax obligations;

- checking the legality and “purity” of funds received from some dubious financial transactions;

- guarantee of investigative actions in case of detection of suspicions of illegal actions of the company management.

Initiating authorities

To talk specifically about the regulatory support for the seizure of the RS of an enterprise or individual entrepreneur, it is necessary to accurately determine the circle of organizations (persons) that have the right to initiate and (or) make a decision on the seizure of funds in a bank account. These include:

- arbitration courts and courts of general jurisdiction (it all depends on the type of litigation - civil or between legal entities);

- bailiffs (bailiffs);

- Federal Tax Service authorities;

- authorities of the Federal Customs Service;

- territorial divisions of the Federal Financial Monitoring Service;

- if there is a suspicion that the company (IP) is conducting operations with signs of acts prohibited by legislation on financial monitoring.

Regulatory regulation

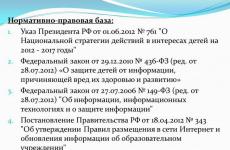

The procedure for seizing the current account of an enterprise (IP) is worked out in great detail in Russian legislation and is regulated by the following regulations:

- Federal Law No. 395-1 “On Banks and Banking Activities” dated December 2, 1990 (Article 27);

- Criminal Procedure Code of the Russian Federation (Article 115);

- Arbitration Procedural Code of the Russian Federation (Article 91);

- Federal Law No. 229 “On Enforcement Proceedings” dated October 2, 2007;

- Tax Code of the Russian Federation (Articles 31, 70);

- Federal Law No. 311 “On customs regulation in the Russian Federation” dated November 27, 2010 (Article 155);

- Federal Law No. 115 “On combating money laundering (legalization) of proceeds from crime dated 08/07/2001 (Article 8).

About the features and rules of blocking the account for a failed declaration is explained by a specialist in the video below:

Grounds for arrest

It is important to understand that a ban on a company conducting transactions on its own current account cannot be created just like that, without reason. It is logical that such actions by authorized bodies are carried out only in the presence of justified violations of the law or suspicions of such violations.

- Federal Tax Service Bodies may want to seize the tax agent's account for the following reasons:

- the presence of fines, penalties and other payments provided for by the current legislation of the Russian Federation;

- failure to deliver within the stipulated time frame;

- failure to submit tax returns on time;

- lack of confirmation from the taxpayer of receipt of documents that the tax office sent to the recipient.

- Customs authorities have the right to block the account of an enterprise only in case of failure to make payments on customs obligations on time.

- Bailiffs make a decision to freeze the account only if there are the following grounds:

- the court's decision;

- the need to guarantee the ability to fulfill the requirements of a lawsuit against an organization or individual entrepreneur on the part of other legal entities or individuals.

- Court may make a decision to arrest the RS if there is:

- statements by the organization’s creditors about facts of failure to fulfill obligations to them;

- supplier statements;

- a lawsuit by the company's employees, which involves;

- petitions from authorized state bodies.

Overlay procedure

Petition and application for arrest

A petition to seize funds that are in the company’s current account is submitted to the court, which is considering the plaintiff’s claim against the company or individual entrepreneur. The main purpose of this petition is to provide some assurance of enforcement of the claims filed.

The application must provide the following information:

- court details;

- information about the plaintiff;

- information about the defendant;

- information about the filed claim;

- motivation and legislative justification for the need to approve the application for execution. It must be indicated that the plaintiff filed a lawsuit in order to obtain money from the defendant for goods supplied or services provided. Since the money was not received, the company or individual plaintiff wants to have certain guarantees of receiving a settlement;

- date and signature of the applicant.

An application for seizure is submitted by the plaintiff to the court. The text of the document must indicate the following information:

- court details;

- information about the plaintiff and the defendant;

- information about the lawsuit filed against the defendant;

- details of the defendant's bank accounts;

- a request to seize funds in these accounts;

- date and signature of the applicant.

You can submit an application to the Bailiff Service department at.

Example of a statement in the BSC

Procedure

Let's consider several options for the procedure.

Option #1

A creditor or other organization that has a claim against the defendant files a lawsuit against him. In parallel with the statement of claim for the recovery of funds (or a little later), a petition is filed to ensure the fulfillment of the requirements of the claim (or a statement of arrest of the settlement account). The court makes a decision to satisfy the petition (application). After this, the court decision is sent to the bailiff organization. Based on the information received, the bailiffs open enforcement proceedings and issue an order to seize the account, which is sent to the bank where the account is opened.

Let us note the presence of one nuance.

- If all details and account balances are known, then the FSSP issues a decision to seize the funds, indicating the amount.

- If the details and account balances are not known, then the FSSP will decide to freeze all the company’s accounts.

Option No. 2

- The tax inspectorate, on the basis of its powers, makes a decision to arrest the account.

- This decision is sent to the bank and is mandatory.

- The bank does not have the right to carry out debit transactions on the account in full or within the blocked amount.

Option No. 3

The decision to seize funds in the account is made by the Federal Customs Service. The procedure is similar to option No. 2. Similarly, funds can be seized for up to 30 days by order of the Federal Service for Financial Monitoring, which is sent to the bank where the company’s (enterprise, individual entrepreneur) accounts are opened.

How to check a PC for arrest

Since 2014, an online service called “System for informing banks about the status of processing electronic documents” has been operating on the website of the Federal Tax Service of the Russian Federation. The work of this service is aimed at providing banks and other interested organizations with information about the presence/absence of blocking of accounts of a certain company. To obtain information, you must send a request indicating the following data:

Since 2014, an online service called “System for informing banks about the status of processing electronic documents” has been operating on the website of the Federal Tax Service of the Russian Federation. The work of this service is aimed at providing banks and other interested organizations with information about the presence/absence of blocking of accounts of a certain company. To obtain information, you must send a request indicating the following data:

- the goal is to obtain data on the suspension of operations;

- TIN and ;

The system will process the information within the time limits established by law and a letter will be sent to the email specified in the request with information about the presence/absence of restrictions imposed on the company's account.

How to pay salary

It is clear that the organization is obliged to pay its employees the money they earn. The following payment methods are allowed:

- in cash through the company's cash desk. For example, a company received cash from a product buyer and does not deposit it in a bank account, but pays wages to employees;

- at another bank. Please note that all operations must be carried out urgently (for example,), since information about the account will reach the tax authorities in a few days and it may also be blocked;

If it is not possible to pay the salary using the above methods, the company is obliged to contact the relevant government authorities with an explanation of the reasons for not paying the salary on time.

Possibility of opening a new PC

According to paragraph 12 of Art. 76 of the Tax Code of the Russian Federation, the bank in which the account is opened has no right if the old current account is blocked. This prohibition applies even if the organization decides.

The organization has the right to open a new account in another bank, but there are some nuances:

- Before opening an account, the bank can use the online service of the Federal Tax Service and understand that the company has a blocked account. Based on this information, a refusal to open a new account is possible;

- The bank is obliged to report this fact to the Federal Tax Service within 7 days after opening a new account. It is clear that the tax office may block this account.

How to get around sanctions

There are three legal ways to bypass the arrest of a personal account:

There are three legal ways to bypass the arrest of a personal account:

- opening a bank account in another bank and urgently carrying out important transactions;

- conducting transactions using cash;

I’m reading No. 229-FZ

Article 46. Return of the writ of execution to the claimant after the initiation of enforcement proceedings

1. The writ of execution, according to which the recovery was not carried out or was made partially, is returned to the claimant:

1) at the request of the claimant;

2) if it is impossible to execute an executive document obliging the debtor to perform certain actions (to refrain from performing certain actions), the possibility of execution of which has not been lost;

3) if it is impossible to establish the location of the debtor, his property or to obtain information about the availability of funds and other valuables belonging to him in accounts, deposits or storage in banks or other credit organizations, except for cases when this Federal Law provides for a search for the debtor or his property;

4) if the debtor does not have property that can be foreclosed on, and all measures taken by the bailiff permissible by law to find his property were unsuccessful;

5) if the claimant refused to retain the debtor’s property that was not forcibly sold during the execution of the writ of execution;

(as amended by Federal Law dated March 12, 2014 N 34-FZ)

6) if the claimant, by his actions, interferes with the execution of the writ of execution.

7) if the debtor who has not paid the administrative fine is a citizen of a foreign state or a stateless person and was expelled from the Russian Federation on the basis of a judicial act.

(Clause 7 introduced by Federal Law dated December 28, 2013 N 383-FZ)

2. In the cases provided for in paragraphs 2 - 7 of part 1 of this article, the bailiff draws up an act on the existence of circumstances in accordance with which the writ of execution is returned to the recoverer. The act of the bailiff is approved by the senior bailiff or his deputy.

(as amended by Federal Laws dated July 18, 2011 N 225-FZ, dated December 28, 2013 N 383-FZ)

(see text in the previous edition)

3. The bailiff issues a ruling on the completion of enforcement proceedings and on the return of the enforcement document to the recoverer.

4. The return of the writ of execution to the claimant is not an obstacle to the repeated presentation of the writ of execution for execution within the period established by Article 21 of this Federal Law.

5. If the executive document is returned to the claimant in accordance with paragraph 4 of part 1 of this article, the claimant has the right to re-present for execution the enforcement documents specified in parts 1, 3, 4 and 7 of Article 21 of this Federal Law, no earlier than six months from the date of the decision to terminate enforcement proceedings and the return of the writ of execution to the claimant, and other writs of execution no earlier than two months or before the expiration of the specified period in the event that the claimant provides information about a change in the debtor’s property status.

(Part 5 introduced by Federal Law dated December 28, 2013 N 441-FZ)

Blocking a bank account is not a pleasant event. After all, the company can no longer withdraw money for its own needs or transfer it to the supplier; in fact, it becomes paralyzed. Nevertheless, there is a way out of this situation. It’s easy to cause problems with your current account: all it takes is for an accountant to delay submitting a return for two weeks or not pay some tax on time. For this, inspectors will be able to suspend operations on the company’s account. This right is given to them by Article 76 of the Tax Code.

Let's be clear. Account transactions are not completely blocked. So, money can be credited to it, but the company can no longer spend it. The bank itself does not have the right to allow a company to manage money in a blocked account.

The only exceptions are cases when an organization transfers money (Article 855 of the Civil Code of the Russian Federation):

Who can seize a current account

First of all, the right to block current accounts is given to employees of the Ministry of Taxes and Taxes (Article 76 of the Tax Code of the Russian Federation). Please note that it does not apply to the Federal Service for Combating Economic Crimes (formerly the tax police). After all, now this department belongs to the Ministry of Internal Affairs and is no longer classified as a tax authority.

In addition to tax authorities, customs inspectors can also seize an account (Article 46 of the Tax Code of the Russian Federation). However, they can exercise this right only if the company has arrears in paying customs duties.

Arrest procedure

It varies depending on the basis on which inspectors “freeze” the account. Let's remind them:

To do this, inspectors must make a written decision to collect the arrears. They are given no more than 60 days to do this from the date of expiration of the period specified in the request for tax payment. Simultaneously with this decision, the tax authorities must decide to suspend operations on the account. They need this so that the taxpayer does not have time to “withdraw” all the money from the account before the bank writes off the money due to the budget.

In the second case, no demands are sent to the company. As soon as the inspection makes a decision to suspend operations on the account, it will be sent to the bank. At the same time, the tax office must hand over the decision to you against receipt or send it by mail.

However, if you are late filing your tax return, it is not difficult to correct the situation. It is enough just to submit this declaration, and the next day the tax authorities will unblock the account (Clause 2 of Article 76 of the Tax Code of the Russian Federation). True, you will still have to pay the late fee provided for in Article 119 of the Tax Code.

If the account was blocked due to non-payment of tax, the inspectorate will cancel its decision only after you pay off the debt and submit a supporting document (Clause 6, Article 76 of the Tax Code of the Russian Federation). This can be either a collection or payment order with a bank mark for execution.

Once you receive a decision to suspend account transactions, pay attention to two important points.

Firstly, the decision must be signed by the head of the tax office that sent the demand for tax payment, or his deputy.

Secondly, it must be issued simultaneously with a collection order to the bank to transfer tax to the budget from the funds in the company’s account. If at least one of the rules is violated, the account is seized illegally. However, this will most likely have to be proven in court.

I protest...

Having received a decision from the tax inspectorate, the bank will not figure out whether it is legal, it only must execute it (Clause 4 of Article 76 of the Tax Code of the Russian Federation). Of course, you can submit a complaint to the Ministry of Taxes and Tax Administration about unlawful actions of inspectors. However, it is rarely possible to achieve a positive result with this.

The situation is different with arbitration practice. Even a completely legal decision to suspend operations on an account can be overturned by a judge.

Example 1If the procedure for seizing the account is fully complied with, you can draw the attention of the judges to how the decision to collect the tax and to seize the account is formalized. They often lack important details, in particular the amount of arrears and penalties, the name of the tax for which there is arrears, and the period for which the declaration must be submitted.During the audit, the tax inspectorate identified arrears from Firm Orto LLC and sent it a demand for payment of tax and penalties. The company did not repay the arrears within the prescribed period, and the tax authorities decided to suspend transactions on its accounts.

The company went to court. He found that the demand for tax payment was sent to the wrong address where the company was located. Consequently, the tax inspectorate did not notify her of the identified violation and its actions, as required by the code.

The court declared the decision to block the account invalid (resolution of the Federal Arbitration Court of the North-Western District dated May 21, 2003 No. A05-14995/02-840/20).

So, if you notice any mistakes by the tax authorities in the process of seizing an account, you have every chance of winning the trial.

The most common grounds for appeal are:

the company did not receive a request to pay tax; the decision to freeze the account was made later than the decision to collect the tax; the decision to freeze the account was made by an employee of the Ministry of Taxes, who does not have the right to do this; the company's account was blocked until the expiration of the arrears repayment period specified in the request; the company has no tax debts; the decision to collect the arrears was made later than 60 days from the expiration of the period specified in the request for tax payment.

Example 2There are also cases when a company owes only a small amount to the budget, and inspectors have already notified it that operations on the account have been suspended. However, even in this situation, the company is supported by the court. To overturn the decision, he uses the following formulation: “the organization’s guilt is not commensurate with the degree of responsibility.”Based on the results of the desk audit, the inspectorate held Vito-M LLC liable for failure to submit a tax return on time. The company did not pay the fine, after which employees of the Ministry of Taxes made a decision to suspend operations on its account. The company went to court.

The judge declared the inspectorate's decision invalid. Here are his arguments.

The tax office may decide to suspend transactions on the account if the company is late in filing its declaration by more than two weeks. The decision was made, but it did not indicate for what period the company did not file a declaration. Consequently, the decision does not comply with the requirements of the law and is invalid (resolution of the Federal Arbitration Court of the North-Western District of May 6, 2002 No. A56-2294/02).

Example 3As you can see, litigation is a fairly effective way to deal with tax inspectors. However, they usually last more than one month, and the prospect of being left without a current account for all this time is depressing.JSC "Krasnoyarsk Bread" did not submit to inspection

(at the location of the branch) income tax declaration.

The inspectors decided to suspend operations on the company's account. She, in turn, went to court.

The judge found that the income tax in the amount

98 rub. the company paid at the location of the parent organization (although it should have paid at its place of registration). The accountant also submitted his tax return there. In case of such violations, the court recognized the measure applied by the tax authorities as not proportionate to the company’s fault, and the decision to block the account was invalid (resolution of the Federal Arbitration Court of the East Siberian District dated February 21, 2002 No. A33-9798/01-S3A-F02-225 /02-S1).

However, the company has several opportunities to conduct settlements with a frozen account.

New account

The easiest way out of this situation may be to open a new account in another bank. Fortunately, the Tax Code does not prohibit this, and banks do not require any certificates from the inspectorate from companies when opening accounts.

Within five days after the company has an account, the bank will notify the tax office where it is registered. Of course, upon receiving such a notification, the inspectors will immediately send a decision to the bank to suspend operations on the new account.

However, in this case, the calculation is made that by the time the notification from the bank reaches the tax office and the decision to freeze the account comes from there, the company will have time to carry out all the operations it needs.

This method has one, but significant drawback. The fact is that tax inspectors may regard such actions by a company as tax evasion “in another way.” And this already threatens to initiate a criminal case under Article 199 of the Criminal Code.

However, this will not happen if you can prove that paying off the debt to the budget will lead to bankruptcy of the company.

Cash payments

If your company does not have the opportunity to pay a counterparty by bank transfer, use cash. The Tax Code does not prohibit this. But remember that the Central Bank limited the amount of “cash” settlements for one transaction to 60,000 rubles (directive of the Central Bank of the Russian Federation dated November 14, 2001 No. 1050-U). In our opinion, this is the best way out of the situation for companies whose expenses do not exceed this limit.

It should be noted that this limitation can be bypassed if desired. It is enough just to split the transaction into two contracts (more are possible) or use bills of exchange in calculations. If the amount of expenses is much larger, try to pay by barter. Unfortunately, not all counterparties may agree to this step.

Deferment or installment payment

If these methods do not suit you, you can try to get a deferment or installment payment of the tax. They are provided for a period of one to six months. In the first case, the payment deadline is postponed to a later date. But as soon as it comes, the company must fully repay all debt. Installment plans provide for the gradual repayment of debt over a certain period of time.

We would like to warn you that the Ministry of Taxation is very reluctant to give such permissions. In addition, the list of cases when a company can ask for a deferment or installment plan is strictly limited (Article 64 of the Tax Code of the Russian Federation). Here are some of them:

S. Fomenko, PB expert

Learn to prepare management reporting in our new. Owners are willing to pay more for management reports than for tax reports. We'll give you an algorithm for setting up reports and show you how to integrate them into your daily accounting.

Distance learning. We issue a certificate. for the course “Everything about management accounting: for accountants, directors and individual entrepreneurs.” For now for 3500 instead of 6000 rubles.

Mikhailovsky Yuri Iosifovich(02/09/2014 at 20:33:12)

Good evening! They may seize the account, provide a deferment or installment plan. Write an Application addressed to the senior head of the OSP UFSSP of Russia of your region, if it does not help, then you can file Complaints against the actions of the bailiff and senior bailiff of the head of the OSP UFSSP of Russia of your region to the Prosecutor's Office and the Court (not subject to state duty), all this can be sent by registered mail letters with notification and inventory. Article 37 of the Federal Law "On". Granting a deferment or installment plan for the execution of judicial acts, acts of other bodies and officials, changing the method and procedure for their execution 1. The claimant, debtor, bailiff has the right to apply for a deferment or installment plan for the execution of a judicial act, act of another body or official , as well as about changing the method and procedure for its execution to the court, another body or to the official who issued the executive document. 2. If the debtor is granted a deferment in the execution of a judicial act, an act of another body or official, enforcement actions are not performed and enforcement measures are not applied within the period established by the court, other body or official that granted the deferment. 3. If the debtor is granted an installment plan for the execution of a judicial act, an act of another body or official, the executive document is executed in that part and within the time limits established in the act on granting the installment plan. Article 441 of the Civil Procedure Code of the Russian Federation. on challenging decisions of officials of the bailiff service, their actions (inaction) 1. Resolutions of the chief bailiff of the Russian Federation, chief bailiff of a constituent entity of the Russian Federation, senior bailiff, their deputies, bailiff, their actions (inaction) can be challenged the claimant, the debtor or persons whose rights and interests are violated by such a resolution, actions (inaction). 2. An application to challenge the decisions of an official of the bailiff service, his actions (inaction) is filed with the court in the area of \u200b\u200bactivity of which the specified official performs his duties, within ten days from the date of the decision, the commission of actions, or from the day when the claimant, debtor or persons whose rights and interests are violated by such a resolution, actions (inaction), become aware of a violation of their rights and interests. 3. An application to challenge decisions of an official of the bailiff service, his actions (inaction) is considered in the manner prescribed by Chapters 23 and 25 of this Code, with the exceptions and additions provided for by this article. 4. Refusal to challenge a bailiff may be appealed in the manner prescribed by this article.