How to calculate dividends in 1C complex automation. Enter an employee into the directory Employees of the organization

Let's look at an example of how to calculate and pay dividends to employees of an organization. In this example, the profit to be distributed is 80,000 rubles. Dividends are paid to two founders - employees of the organization in equal shares.

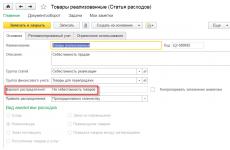

To do this, we need the document Accrual of dividends for an organization (Main menu -> Calculation of salaries for organizations -> Primary documents -> Accrual of dividends for an organization). Let's fill out the document indicating the total amount of dividends. In the tabular part of the document. Let's add employees who receive dividends. In this case, we have two employees, each with 10 shares. To calculate personal income tax, use the Calculate button.

Having reflected the accrual of dividends, you need to pay them. In the document “Accrual of dividends to the organization”, using the Action -> Based on -> Salary to be paid button, we will create a document for payment.

Fig.2

Using the document Salaries payable to organizations, you can pay dividends only to employees of the organization. If it is necessary to pay accrued dividends to founders who are not employees of the organization, then in this case it is necessary to upload the data into the Accounting program. Reflecting the posting: Dt 84.01 Kt 75.02 - for the amount of accrued dividends and Dt 75.02 Kt 68.01 - for the amount of withheld personal income tax.

Liked? Share with your friends

Consultations on working with the 1C program

The service is open specifically for clients working with the 1C program of various configurations or who are under information and technical support (ITS). Ask your question and we will be happy to answer it! A prerequisite for obtaining consultation is the presence of a valid ITS Prof. agreement. The exception is the Basic versions of PP 1C (version 8). For them, a contract is not necessary.

1C accounting 3.0 accrual and payment of dividends to the manager. In our article we will tell you in detail how to calculate and pay dividends to an individual using the 1C Accounting program.

First of all, let’s define the concept of “Dividends”. So, dividends are any revenue that the founder (shareholder or member of the company) receives as remuneration at the stage of distribution of the company’s net profit.

Profit is considered to be revenue after payment of all necessary taxes. This revenue is distributed among the participants, depending on their share in the authorized capital of the enterprise, unless other provisions are specified in the company's charter.

The company body that has the right to decide on the payment of dividends is the general meeting of company participants. In accordance with the law, dividends are paid a maximum of once every 3 months. How funds will be paid and within what period should be specified in the organization’s charter.

Let's look at how to calculate dividends in the 1C program

1C accounting 3.0 accrual and payment of dividends to the manager

To calculate dividends, we will use the document “Operation entered manually.” To do this, select the menu item on the navigation panel

“Operations” -> “Operations entered manually.”

Then we will create the following transactions:

Debit 84 Credit 70, as the amount we will indicate the amount of accrued dividends.

Debit 70 Credit 68.1, indicate the amount of personal income tax, 13%.

The next document that we need to enter is the document “Personal Tax Accounting Transaction”.

To do this, select the item on the navigation panel

“Salaries and personnel” -> “All documents on personal income tax”

Then we create a new document.

We fill out the document in accordance with the figure below, indicating your data, in the income code field we indicate the numbers 1010.

After completing these documents, the personal income tax amount will be shown in the 2-personal income tax report.

With all the variety of materials on our website, we have so far ignored an important and necessary topic - the calculation of dividends to the founders (shareholders) of the organization. After all, the ultimate goal of any business activity is to make a profit. It’s great when this goal is fully achieved, the company operates successfully, and the owners can enjoy the results of their work. But how to reflect the fact of accrual of dividends and personal income tax on these incomes in the 1C: Enterprise Accounting 8 edition 3.0 program? Let's look at this situation with practical examples.

Dividends to employees of the organization

To calculate dividends and withhold personal income tax from these incomes, go to the “Operations” tab and select the “Operations entered manually” item.

We create a new document and add a posting between accounts 84.01 and 70, because We are talking about the founders (shareholders) who are employees of the organization. As the date of the document, we indicate the date of the decision on the distribution of net profit by the meeting of founders.

It is also necessary to add to the document entries for withholding personal income tax from dividend amounts.

But in order for the tax to be reflected in forms 2-NDFL and 6-NDFL, these postings are not enough; you need to create another document that generates movements in the personal income tax registers. Go to the “Salaries and Personnel” section and select the “All personal income tax documents” item.

We create a document “Personal Income Tax Accounting Operation” for each founding employee.

In the header of the document, select the organization and employee. In the “Operation Date” field, you must indicate the date of dividend payment.

Fill out the “Income” tab.

And the “Withheld on all bets” tab.

Please enter your tax withholding information carefully, as... It is according to the data in this tab that section 2 of the 6-NDFL form will be filled out.

The date of receipt of income in this case is the date of payment of dividends, and the deadline for transferring taxes is “No later than the day following the payment of income.” We indicate the amount of income paid without deducting personal income tax.

Also on both tabs there is a column “Include in profit declaration”. This checkbox must be checked if dividends paid by the JSC are recorded. In this case, information about accrued amounts and withheld tax will NOT be included in Form 2-NDFL, but will be reflected in the income tax return.

We navigate and close the document. All that remains is to pay dividends, and there is an important nuance here. Despite the fact that the founders are employees of the organization, and the accruals are reflected in account 70, they should not be included in the salary statements. Accordingly, debits from a current account or withdrawal of cash from a cash register must be reflected with the transaction type “Other write-offs” (“Other expenses”).

Dividends to founders (shareholders) who are not employees of the organization

In the event that it is necessary to accrue dividends to individuals who are not employees of this organization, the procedure in 1C: Accounting will be similar, the changes will affect only the accounting accounts used: in this case, we will accrue dividends and withhold personal income tax in correspondence with account 75.02, and not 70.

The postings will look like this:

Please note that the “Counterparties” directory is used as analytics on account 75.02, and not the “Individuals” directory, as on account 70.

To reflect information about dividends in personal income tax reporting forms, fill out the document “Personal Tax Accounting Operation”, located on the “Salaries and Personnel” tab - “All documents on personal income tax”. But to work with this document, the founder will need to be added to the “Individuals” directory, because We cannot record the withholding of personal income tax from the counterparty.

We also indicate the date of dividend payment as the transaction date. Fill out the “Income” tab in the same way.

and the “Withheld on all bets” tab.

We process the document and register the payment of dividends. In this case, as in the previous example, we create a debit from the current account or a cash issue with the transaction type “Other debit” (“Other expense”), but indicate 75.02 as the corresponding account.

Let's be friends in

In fact, dividends are what the enterprise, or more precisely the owner(s) of the enterprise, works for. This is the part of the profit that is divided among the founders in accordance with their share of participation.

Dividends are income of an individual or legal entity. Therefore, dividends (in the case of an individual) are subject to. And we will also do this calculation. In other words, it is part of net profit.

At the moment, we have five personal income tax rates in our accounting:

- 13% is the most basic and common. Levied from individuals of the Russian Federation who have received income;

- 9% is the simplest and smallest rate. Superimposed on the income of individuals who have a share in the activities of third parties;

- 15% - taken from income from persons who do not have citizenship in Russia, but receive income from Russian companies as co-investors or investors;

- 30% - taken from the income of persons not included in the previous paragraph;

- 35% - personal income tax on income from winnings and bank interest, if this does not exceed the limit established by law.

Get 267 video lessons on 1C for free:

Let's look at step-by-step instructions on how to pay and accrue dividends in the 1C 8.3 Accounting 3.0 program, as well as how to register personal income tax for the founders from this income. The instructions will be similar for calculating dividends in 1C 8.2.

Accrual of dividends by postings using the 1C document “Operation”

It’s worth noting right away that there is no special document for calculating dividends in 1C 8.3 Accounting, so we will do it manually.

There, select the “ “ item through the “Create” button. This is what it looks like:

Postings for calculating dividends in 1C

Dividend postings in 1C look like this:

- If the program maintains records for several organizations, then you will need to enter the organization. Next, you need to enter the total amount of the transaction and the content of the transaction.

- Contents: “Dividends, accrual. Individual (excluding employees of the organization).” Dt: 84, Kt: 75 (subconto depends on the specifics of each organization).

- Contents: Personal income tax withheld. An individual is an employee of an organization. Dividends can also be accrued to an employee of the organization. Personal income tax may also be withheld from the employee. In this case, instead of the 75th count, the 70th count should be used.

- And finally, the entries for the payment of dividends: Dt: 75.2, Kt: 50, 51, 52 (can be completed with the help of documents).