Transport tax: payment methods and refunds. Is it possible to return transport tax? Is it necessary to return overpayment of transport tax?

When carrying out its activities, an economic entity must, if there is a tax base, calculate and pay mandatory payments to the budget. Sometimes the situation develops in such a way that either he himself allows an overpayment of any tax, or the Federal Tax Service Inspectorate withdraws the tax without acceptance. At the same time, the legislation provides for the refund of overpaid taxes.

If a subject sees an overpayment of mandatory payments, then first it is necessary to figure out how it arose.

This may be the case if:

- An error was made when paying taxes.

- If advance payments at the end of the year turned out to be more than in the annual declaration (for example, an overpayment of income tax or an overpayment according to the simplified tax system is reflected at the end of the year in).

- Use of tax benefits when tax is simultaneously paid by a legal entity and withdrawn by decision of the Federal Tax Service, etc.

Overpayment of taxes can be refunded only when the tax authorities agree with this fact. The Tax Code of the Russian Federation establishes that the Federal Tax Service must inform the payer about this within 10 days from the moment the excess payment is discovered so that he can make an appropriate decision. But in practice this happens very rarely.

However, the taxpayer himself has the right, if an overpayment is detected, to submit an application for a refund of the amount of overpaid tax. Before this, it is advisable for him to reconcile the calculations with the Federal Tax Service. You don’t have to do this, then the inspectors of the Federal Tax Service, if questions arise, will ask you to provide a number of documents that confirm the fact of the overpayment.

bukhproffi

Important! The taxpayer must also remember that a refund of overpaid tax is possible only if three years have not passed since the overpayment.

If the overpayment occurred due to the fault of the tax authorities, then this tax amount can be returned within one month from the moment the taxpayer learned about it, or from the date the court decision entered into force.

However, in the latter case, the Federal Tax Service can take advantage of three months to verify the fact of the overpayment and make a decision on the refund.

In which case is it not possible to return the money?

There are also situations when the Federal Tax Service refuses to refund the overpaid tax. Quite often this is due to the fact that taxpayers miss the statute of limitations established by law in the form of three years - if the overpayment of taxes arose due to the fault of the enterprise, one month - when the inspectorate itself is to blame.

Here, proof of the time of discovery of the fact of overpayment of tax is of great importance. If the taxpayer has the opportunity to submit them, and they do not exceed the established deadlines, then through court proceedings it is possible to obtain the return of overpaid tax.

Attention! A refusal to refund overpaid taxes can be obtained if the company has arrears to the budget. Indeed, in this case, the Federal Tax Service is given the right to carry out an offset without acceptance.

Refund or credit - which is better?

In addition to a tax refund, the taxpayer has the right to ask the Federal Tax Service to offset the amount of any overpayment of tax against the enterprise's existing obligations to the budget.

However, there is a limitation when crediting excess tax. It can only be done for taxes within one budget (federal, regional or local).

In most cases, the decision on a refund or offset is made only by the taxpayer (in the absence of tax debts). Therefore, what is better is a credit or a refund, each business entity decides independently, assessing the current situation in specific conditions, as well as the amount of overpaid tax.

Attention! Tax authorities always give preference to offsets, as this will allow them not to return money. Therefore, the offset procedure is much faster and requires fewer documents than a return. Taxpayers must also take this fact into account when making decisions about this.

In addition, it matters in what status the tax overpayment occurred. After all, if an excess payment was made by a tax agent, then he cannot take these amounts into account for obligations where he acts as a taxpayer. Only returns are possible here.

A special KND form 1150058 has been developed for it. It was updated in 2017, and is currently more reminiscent of a declaration. The application must indicate the name of the company, the amount of overpayment, the BCC for the tax, and the details of the taxpayer’s current account.

The completed document is submitted to the Federal Tax Service in several ways:

- In paper form personally by the taxpayer or his representative by proxy;

- By post with notification of receipt;

- In electronic form via the Internet, but this will require.

The process of refunding excess tax can be divided into several stages:

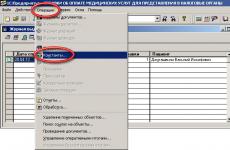

- Determine that an overpayment has occurred. This can be done, for example, by requesting a tax reconciliation report from the Federal Tax Service. The document will show for what tax and in what amount the excess transfer of funds occurred.

- Submit a return application. In it you need to indicate information about the company, the amount to be returned and the details of the bank account to which this should be done;

- Submit the application to the tax office in person or through a representative, by mail or via the Internet;

- After 10 days, receive the result of the application review. If the authority unlawfully refuses a return, prepare documents to transfer the case to court;

- Within a month from the date of filing the application, the Federal Tax Service must return the funds to the current account;

- If the time has expired, but enrollment has not been made, write a complaint to a higher inspection and prepare documents to transfer the case to court.

How to offset overpaid tax

If the taxpayer decides not to make a refund of overpaid tax, he can offset it:

- For further payment of the same tax;

- To pay off a debt for another unpaid tax.

When performing an offset, you must follow the rule - a payment can only be offset within the budget of the same level. Those. an overpayment for a federal tax will be credited only to another federal one, for a regional tax - to another regional one, etc.

The Federal Tax Service has the right, if an overpayment is detected, to independently offset the underpayment of another tax. In this case, the company's consent is not required.

To qualify, you must submit a special form, KND 1150057.

Attention! The offset can be made within 3 years from the date of the overpayment.

Return and credit terms

If a company wants to offset the excess tax amount against future payments, it is necessary to submit an application to the Federal Tax Service. Tax officials must review the document within 10 days and then, within another 5 days, inform the taxpayer about the decision.

If the tax office independently decides to offset an overpayment for one tax against an underpayment for another tax, the inspector must do this within 10 days from the fact of discovering the overpayment. And also, within 5 days the authority must inform about the decision.

If the amount of overpayment is greater than the amount of underpayment, then the tax office must make a offset and return the balance of the overpayment to the current account within 1 month. If this deadline is violated, the taxpayer is entitled to interest.

Attention! If you only need a refund of overpaid taxes, you need to submit an application using a special form. The authority reviews it within the same time frame (10 days), after which it returns within a month. If the deadlines are violated, it is necessary to go to court and demand not only the return of the overpayment, but also interest. You can file a lawsuit within 3 years.

What to do if the tax was written off by mistake

The tax office has the right, without the approval of the taxpayer himself, to withdraw from him unpaid amounts of taxes, fines or penalties.

Sometimes such actions are performed by mistake - for example, the authority did not receive a payment order, or the taxpayer himself made a mistake and indicated the wrong details, BCC number, etc.

If such an event does occur, then the tax office is obliged to return the unlawfully withheld amount. If the company has debts for any other taxes, then part of this payment can be used to pay them off, and the remaining funds will be returned.

To make a refund, you must submit a written application in free form to the Federal Tax Service. It must state the circumstances of the case, attach a supporting document (payment with tax transfer), and indicate bank details for the refund.

bukhproffi

Important! The application must be submitted within 1 month from the date of the unlawful write-off. If this period is missed, the amount can only be returned through legal proceedings. Three years are allotted for this.

It takes 10 days to process the submitted application. Next, the authority is given 1 month to return the amount to the bank account.

The tax office does not want to issue a refund - what to do?

The tax authority may delay processing the submitted application and not issue a refund. In this case, you should not sit and wait for payment, but move on to active actions.

First, you need to make sure that the application contains the correct details for the refund. This can be done on a copy of the document that remains with the submitter.

If the tax inspector refuses to accept the statement that he has no right to do, you can send it via registered mail with notification, or via the Internet. In the latter case, you must have a qualified digital signature.

When talking with a Federal Tax Service employee, you must refer to the fact that the Tax Code sets a tax refund period within a month from the date of receipt of the application. There is no mention of any verification in it.

If, after the time allotted by law for processing the application and refunding the overpaid tax, the tax office does not take any action, you must begin writing complaints. This must only be done in writing and sent by post with notification. By law, the authority is required to respond to the request also in writing.

There is no point in calling or trying to resolve the issue verbally. Such requests are not recorded anywhere; you can promise anything over the phone, but during the trial it cannot be connected to the case.

Attention! If all the deadlines have expired and there is still no return, you need to fill out a statement of claim and go to court. It requires a refund of not only the overpaid tax, but also interest for late payment.

It should be noted that almost all such proceedings end in favor of the taxpayer. The court takes the side of the authority only in cases of violations in the execution of submitted documents.

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION

THE FEDERAL TAX SERVICE

The Federal Tax Service considered the appeal on the issue of administering property taxes and, taking into account the information provided by the Federal Tax Service of Russia for the region (hereinafter referred to as the Department) and the Federal Tax Service of Russia for the city of Moscow, reports that clarifications were sent by letter of the Department dated April 24, 2017 N 17-25/039192 on the issues raised in the appeal.

According to paragraphs 1 and 2 of Article 78 of the Tax Code of the Russian Federation (hereinafter referred to as the Code), if there is an overpayment on property taxes from individuals on a personal account, the amount of overpaid tax is subject to offset against the taxpayer’s upcoming payments for this or other taxes, repayment of arrears for other taxes, debts on penalties and fines for tax offenses or refund to the taxpayer by the tax authority at the place of registration.

The refund of the amount of overpaid tax is made by the tax authority at the place of registration of the taxpayer.

In this connection, documents confirming overpayment of transport tax in the amount of 4,182 rubles. transferred by the Inspectorate of the Federal Tax Service of Russia for the city to the Inspectorate of the Federal Tax Service of Russia for the city of Moscow.

Paragraph 7 of Article 78 of the Code establishes that an application for a set-off or refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount.

In accordance with paragraph 6 of Article 78 of the Code, the amount of overpaid tax is subject to refund upon a written application (application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels or submitted through the taxpayer’s personal account) of the taxpayer within one month from the date of receipt by the tax authority such a statement.

The application form for the refund of the amount of overpaid tax was approved by Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/182@ “On approval of document forms used by tax authorities and taxpayers when carrying out offset and refund of amounts of overpaid (collected) taxes and fees , insurance premiums, penalties, fines" (registered with the Ministry of Justice of Russia on March 17, 2017 N 46000).

Thus, in order to receive a refund of the amount of overpaid tax, you need to contact the Federal Tax Service of Russia in Moscow with an application in the form approved by Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/182@, or send an application in electronic form via Internet service of the Federal Tax Service of Russia "Taxpayer's personal account for individuals."

On the refund of overpaid transport tax

Calculating the amount of transport tax is often accompanied by errors, leading to significant overpayments or arrears of tax. Debt to the regional budget can be repaid within a certain time, after receiving the appropriate notification.

But what can you do if for some reason you overpaid taxes? Where to go and present documents. Let's figure it out step by step.

Overpayment of transport tax may arise as a result of:

- errors in calculations by tax authorities (for individuals) and accounting employees (for legal entities). Currently, quite a lot of personal transport is registered in each structural unit of each region of the Russian Federation. This leads to a heavy workload for tax officials and, as a result, various errors in calculations are possible;

At enterprises, as a rule, there are also several vehicles, which leads to the need for multiple calculations.

- the presence of errors when filling out the payment order required to pay the tax. The payment is transferred using the recipient bank details, which consist of many numbers. An error in one of them will result in the tax amount being credited to another area. Secondary payment entails an overpayment of tax;

- making changes to the traffic police regarding the parameters of the vehicle.

- situations often occur when errors occur when registering a vehicle. Most of them are detected much later. If the traffic police documents indicate that the car’s power is increased, then the tax calculation will be incorrect (from the point of view of the car owner). This leads to an overpayment;

To correct the situation, it is necessary to make changes corresponding to the characteristics of the vehicle in the documents of the traffic police officers.

- payment of advance payments. Situations can be different: basic errors in calculations (and part of the tax has already been paid), sale of a car, and so on;

- the presence of benefits that the car owner was not previously aware of.

In fact, there are a great many reasons for overpayment of taxes. Only the most frequently encountered ones are listed here.

What is the difference between an overpaid amount and an overcharged amount?

Payment of transport tax can be:

- excessively overpaid;

- overcharged.

The overpayment occurs due to the fault of the taxpayer. This may include calculation errors, filling out a receipt incorrectly, or making double payments.

The amount of tax that was overpaid due to the fault of the tax police is considered to be overcharged.

The reasons for excessive penalties may include calculation errors by tax officials and incorrect information received from the traffic police about the characteristics of cars.

How to confirm

Video: REFUND overpaid taxes?

All car owners are charged a transport tax.

Its size is not fixed and depends on the region, engine size, and cost of the car.

Therefore, sometimes owners see incorrect amounts on their tax notice.

Read this article about what to do if transport tax has been calculated incorrectly.

Once a year, each vehicle owner receives a tax notice at the place of registration with information about tax calculations.

The debt must be repaid before the date specified in the document. If the transport tax was calculated incorrectly, the owner has the right to demand a recalculation.

After it has been carried out, the overpayment amount can be offset against tax payment in the next tax period or refunded in full. To do this, you must submit a corresponding application.

Recalculation of transport tax for individuals in 2019 is carried out based on an error in the tax notice, namely:

- inaccuracies in indicating the power of a taxable vehicle;

- application of an incorrect tax rate;

- calculating the amount of tax without taking into account the benefits a person has.

It is in the interests of the car owner to contact the regional office of the tax office from which the notification was received as quickly as possible. To apply, you need to have your passport and car documents with you.

It is in the interests of the car owner to contact the regional office of the tax office from which the notification was received as quickly as possible. To apply, you need to have your passport and car documents with you.

If the vehicle's power is incorrectly indicated, tax officials must request information from the traffic police. There is a possibility that this is where you will have to correct the car data.

If the tax was assessed even though the car had already been sold, it means that the information did not enter the database on time. The former owner will have to contact the tax office and present a purchase and sale agreement.

It is also worth remembering that the tax is calculated only for the period of actual use of the vehicle. If it was stolen and there is evidence of this fact, you can demand a recalculation.

Stage 1. Preparing a statement about errors in the tax notice

If you received the wrong transport tax, you need to know how to write to the tax office. Recalculation is made for a maximum of 3 years based on a written application.

If you received the wrong transport tax, you need to know how to write to the tax office. Recalculation is made for a maximum of 3 years based on a written application.

You can fill it out on the form when visiting the Federal Tax Service in person or on the service’s website. The document must include the following information:

- Full name, taxpayer identification number;

- tax notice number;

- address of the inspectorate where the application is submitted;

- the period for which the transport tax was calculated incorrectly;

- vehicle data.

If an application form is not attached to the tax notice, you can write it in free form, listing the identified errors.

Stage 2. Submitting an application to the tax authority

There are several ways to submit your application and required documents:

- upon a personal visit to the tax office;

- through another person by proxy;

- on the Federal Tax Service website (registration in your personal account or a confirmed electronic signature is required);

- by paper letter by mail.

When choosing a personal visit to the tax office, prepare 2 copies of the application: one will be taken by the inspector, the second with an acceptance mark and date will remain with you.

If you decide to use the services of Russian Post, send your application by letter with a description of the attachment. This will allow you to prove the date and fact of sending the application in the event of a dispute.

The application must be accompanied by a passport, tax identification number, and documents for the car. Depending on the specific situation, additional paperwork may be required:

The application must be accompanied by a passport, tax identification number, and documents for the car. Depending on the specific situation, additional paperwork may be required:

- a certificate from the traffic police if the car was deregistered during the reporting period;

- a certificate confirming that the vehicle was reported stolen;

- a document that determines the power of the car;

- a document establishing the right to a benefit (veteran’s certificate, certificate of presence of a disabled child, etc.).

All documents must be submitted in originals, since transport tax is not recalculated based on their copies.

Stage 3. Waiting for a tax notice with corrected data

When an error is encountered in the transport tax, at the request of the car owner, Federal Tax Service employees must independently find out its cause, recalculate the amount and send a new notification.

The column “Calculated tax amount” should reflect the correct amount, and the column “Amount of tax calculated earlier” should reflect the erroneous amount that was indicated in the initial notification.

The Federal Tax Service is given 30 days from the date of registration of the application to review and verify information on the taxpayer’s application. Before the expiration of this period, the car owner must be sent a notification with corrected data.

If an incomplete package of documents is provided at the request of the tax authority and in some other cases, the time for consideration of the application may be extended, but by a maximum of 30 working days.

Stage 4. Submitting an application for a refund of the overpaid amount

If, after correcting errors in the tax notice, an overpayment is revealed, it is worth filing an application for a refund of the funds paid in excess of the required amount. You can also request that they be offset against future payments.

A written application can be submitted within 3 years from the date of payment of the excess amount. It must be accompanied by copies of the payment document and notification of tax recalculation.

Stage 5. Refund of overpaid tax

The Federal Tax Service must make a decision on offset or refund of the overpaid amount within 10 days. Then the tax office will have 5 working days to send a message to the car owner.

The Federal Tax Service must make a decision on offset or refund of the overpaid amount within 10 days. Then the tax office will have 5 working days to send a message to the car owner.

If there is a debt on penalties and fines or arrears on taxes, the overpayment will first be counted towards their repayment. The remainder of the amount will be returned to the taxpayer upon his request.

The law allows the Federal Tax Service to refund the overpayment 1 month from the date of registration of the application from the car owner. If this deadline is violated, the tax office will have to pay the applicant interest for each day of delay.

The fine is calculated on the amount of overpayment taking into account the current refinancing rate of the Bank of Russia.

What to do if the tax office refuses to recalculate?

There are situations when it is not possible to achieve a recalculation at the tax office at the place of permanent registration, although there are all reasons for this.

Car owners should know where to turn in this case. To defend your legal rights, you should sue the tax authorities.

A statement of claim demanding recalculation of the transport tax is sent to the judicial authority at the location of the organization that assessed it.

To support his position, the car owner must provide the following documents:

- documents providing grounds for recalculation;

- response from the Federal Tax Service with a reasoned refusal to recalculate;

- receipt of payment of state duty;

- other documents required by the court.

The judge will consider the claim and set a trial date. It must be attended by both the plaintiff (taxpayer) and the defendant (representative of the tax office). The court decision will be the final verdict on the disputed issue.

Refund of overpayment of transport tax is one of the most common requests on the Internet. As a rule, the calculation of the tax fee may be accompanied by a number of errors, resulting in an overpayment of funds.

In what cases can transport tax be refunded?

The main reasons why overpayment occurs:

- mistakes made by tax officials. Recently, the number of transport has increased sharply, and it is likely that there may be inaccuracies in basic documents or in calculations;

- changes in the traffic police rules regarding maintenance and basic parameters of cars;

- errors in the payment order;

- the presence of any errors when registering the vehicle;

- the presence of benefits for the car owner, which were revealed later.

It is possible to return the transport tax in all of the above cases.

How to prove?

A citizen of the Russian Federation has the right to return overpaid transport tax if:

- the taxpayer is officially registered with the tax service of the Russian Federation;

- the amount of overpayment is assigned to a specific user and is listed in the budget account;

- the user has no debts on payment of taxes - land, property. If debts exist, it is not possible to return material assets;

- the taxpayer provided a complete set of documentation to the tax service for the return of transport tax;

- there is a special reconciliation act, which is drawn up, registered and signed by the inspector assigned to the taxpayer;

- the results of an audit of the fact of overpayment by the taxpayer were recorded.

In order to prove the right to a transport tax refund to the tax service, you must provide a complete set of documentation that confirms the fact of overpayment of the transport duty.

The procedure for returning transport tax from individuals

In order to correctly complete the process of returning the vehicle duty, you must adhere to a certain algorithm of actions:

- submitting an application to the State Tax Service of the Russian Federation. The document is drawn up according to the established template. It is also necessary to indicate how the tax refund should occur - to the specified bank account or in cash;

- receiving a notification from the Tax Service regarding this application for a refund of transport tax from an individual. Subject to a positive response confirming the overpayment, after some time the material funds will be transferred to the taxpayer’s bank account. On average, it takes one calendar month to review an application for each specific case.

In order to return material assets for transport tax, you must contact the territorial tax authority, according to the taxpayer’s registration address.

How to return tax to a pensioner?

There are some features of the return of overpayments of transport tax to pensioners in connection with existing benefits for this category of persons. In order to return the overpaid fee, the pensioner must:

- submit a written application, according to the established form, for a refund of transport tax, taking into account the required benefits. The reasons for providing preferential conditions must be indicated;

- submission of a full package of documents, including for registered vehicles, indicating technical characteristics. The average application review period lasts about 3 calendar months.

Pensioners are required to present a pension certificate.

Tax refund for a sold car

Transport duty is charged for a sold car in the following cases:

- when selling vehicles by proxy of the owner;

- delay in notifying the tax service by the car owner about the sale of the vehicle.

In order to receive a transport tax refund for a sold car, you must:

- visit the State Traffic Inspectorate with an agreement on the purchase and sale of a car to issue a document that confirms this action;

- the received certificate should be submitted to the territorial tax authority with a request to return funds for previously paid transport tax. Refunds are made within a calendar month.