Labor law is new in the year. Changes in reports and references

Since 2019, a lot of labor legislation will come into force that will affect both employers, and the working population, and pensioners. In this article, we will look at the key innovations and amendments that must be taken into account today.

Increasing the minimum wage

The minimum wage increases by 117 rubles and from January 1 it is 11,280 rubles. Along with this, fines, sick leave, etc., calculated on the basis of the size, will also grow. True, in some constituent entities of the federation this change may go unnoticed. Regions can raise the minimum wage, and as long as this value is not lower than the federal one, it should not necessarily grow along with the all-Russian minimum wage.

If an organization wants to rely in its calculations not on the regional, but on the federal minimum wage, this is also permitted by law. Within 30 days after the regional minimum wage has been established, the employer must draw up a written refusal to join the regional agreement and send it to the local labor authority. If this was not done, then all benefits and sick leave should be calculated according to the minimum wage, which is established in the given subject of the federation.

Pension reform

Under the old legislation, men born in 1959 and women born in 1964 would have been able to retire in 2019. But from January 1, 2019, the retirement age will gradually increase - once every two years, the bar will be raised by 1 year.

That is, the mentioned citizens born in 1959 and 1964. will be able to retire only in the second half of 2019, and the first half of the year will have to work. Benefits allowing retirement a year ahead of the new deadline are provided for those who, under the old conditions, would have retired in 2019-20.

Criminal liability for refusing to hire citizens of pre-retirement age

One of the main arguments against the pension reform was the fact that it is difficult for pensioners to find a job, it is difficult to stay in the same place, since they are inferior to new qualified personnel and cannot continue to perform their duties well.

To somehow compensate for this problem, the state provided for criminal liability for those employers who refuse to hire candidates only on the basis of the pre-retirement age (that is, when a person is 5 years or less before retirement).

If the employer fails to support his refusal with other arguments, and the citizen suspects the refusal precisely because of his age, he can complain about this organization. If proven guilty, the penalty may be as follows:

- a fine of up to RUB 200,000;

- a fine of up to 18 wages for an employee who refused to hire;

- 360 hours of compulsory work.

Unemployment benefit for citizens of pre-retirement age

Another measure aimed at protecting people who are 5 years or less before retirement. If an ordinary unemployed person can receive a maximum of 8,000 rubles as an allowance, then for citizens of pre-retirement age the amount reaches the full amount of the minimum wage, that is, 11,280 rubles. You can receive benefits for a total of 12 months, which can be spread over a period of one and a half years.

If, before registration, the employee's experience is less than 26 weeks, then he will receive only the minimum amount - 1,500 rubles. For all others, the amount of the benefit changes as follows:

- first, second and third months - 75% of previous earnings;

- fourth, fifth, sixth, seventh months - 60% of past earnings;

- the remaining months, but no more than 12 months in total - 45% of earnings.

For women with more than 20 years of experience and men with more than 25 years of experience, special benefits are provided. Each year above these seniority thresholds brings them an additional two weeks in which unemployment benefits will be paid. In total, the allowance can be paid to them for 24 months over three years.

These conditions apply only to citizens of pre-retirement age. For the rest, it is possible to receive benefits only for 6 months within a year. At the same time, the first 3 months are 75% of the average monthly earnings, in the future - 60%. Payment extension is not provided.

Day off for prophylactic medical examination

Previously, citizens had to undergo medical examination in their own time or take unpaid time off (at their own expense). Now the legislation provides for the employee the right to get time off every three years to undergo medical examination.

If an employee has less than five years left before retirement, or he has already reached retirement age, but continues to work, then the law gives him the right to take two days off a year.

In both cases, the employee must retain his position, place of work and average earnings. The state also thought about employers and obliged the employee to agree in advance on the day on which he would take this day off, so as not to disrupt the work process. A written application must be submitted, which is approved by the head.

Anytime vacation for parents with many children

Since 2019, employers have no right to deny parents with many children on leave during the period requested by the employee. If a citizen is considered to have many children (has three or more children under the age of twelve), he can leave at any time convenient for him, and the boss has no right to refuse or move him to another month.

Professional income tax for self-employed

As an experiment, a tax on. If an individual carries out an activity and receives income from it, but at the same time does not have an employer and does not involve hired employees in the implementation of this activity, then he can become a payer of such tax.

Individuals will have to pay 4% for the sale of goods / services, and 6% for the sale of goods / services to legal entities. So far, the tax has been introduced in Moscow and the Moscow region, the Kaluga region and the Republic of Tatarstan. To date, there is no talk about introducing this tax in other regions, since very little time has passed since the introduction of the tax, and the state did not have the opportunity to assess its effectiveness.

Tightening the rules for working with foreigners

On January 16, 2019, amendments entered into force, according to which the receiving party, that is, the employer, must control several aspects at once for each foreign employee:

- To hire a foreigner only in the specialty that is listed in the permit for.

- If a person does not have documents permitting work in the Russian Federation, then employment should be denied.

- The employer must himself notify about the entry of a foreign employee who will work for him, monitor the timing of his stay in Russia and, if necessary, apply for an extension in Russia.

- If there is no need for an extension, then the employer must promptly break off labor relations with the migrant, facilitate his departure to his homeland, and also report this to the Ministry of Internal Affairs.

Also, the permissible shares of migrant workers in various types of economic activities have been changed:

- in construction - no more than 80% (with the exception of Moscow, Khabarovsk Territory and Amur Region);

- growing vegetables - no more than 50% (except for the Primorsky Territory and the Astrakhan Region);

- activities of other land passenger transport - no more than 26% (previously it was 28%);

- the activity of road freight transport - no more than 26% (previously it was 28%).

Employee transportation licenses

Some organizations independently transport employees (to the place of work and back or somewhere else - it does not matter). From 2019, such organizations must obtain a license to carry out transportation or entrust this work to other companies that have such a license.

However, the government has not yet adopted the regulations on licensing such transportation, so it is not completely clear how the process will be organized. In any case, until June 29, 2019, licenses will not be checked and punished for their absence. And by that time there should be a provision clarifying all the controversial points.

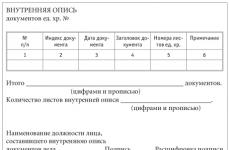

Changes in reports and references

The procedure for filling out the 2-NDFL certificate is slightly complicated. In fact, now there will be two versions of the certificate - one is intended for the tax authorities, the second - for the employee when he needs to confirm the level of income.

Also, a new form of form No. 1-T (on working conditions) is being introduced. The last day of delivery is January 21, but you need to take it in an updated form.

Form No. 3-F "Information on overdue wage arrears" has also undergone changes in the title page and in the very procedure for filling out. True, the updated form will need to be handed over only from February.

Monthly and quarterly reports in the form №P-4 "Information on part-time employment and movement of workers" also received new title pages. The first reports in 2019 will need to be submitted in an updated form.

What else can be introduced

Currently, these measures are only being discussed by the deputies, but it is quite possible that they will be adopted during 2019:

- a ban on changing the terms of an employment contract with pregnant women;

- the abolition of such a punishment for as "warning" - in other words, they will not be warned, but immediately fined;

organizations with a staff of more than 250 people may be obliged to hire 2% of graduates of universities and colleges between the ages of 18-25.

In contact with

Domestic labor legislation for the effective performance of regulatory functions requires periodic revision, additions, changes. Several innovations will take effect in 2017. HR officers should pay attention to several aspects of the employment relationship between the employer and employees.

Announcement of legislative innovations

Actual changes will affect the registration of temporary disability. HR specialists will have to calculate the corresponding payments in a new way. The issuance and procedure for payment of the certificate of incapacity for work will also change.

In the new year, professional standards, which were previously mainly advisory, will become mandatory. All employers, without exception, will have to comply with the requirements of the law, regardless of the organizational and legal form of the legal entity, the specifics of the registration of labor relations. To date, several new professional standards have already been approved. The most expected was the teacher's standard. The approved document objectively evaluates the activities of specialists in this profession without using hopelessly outdated technocratic methods and techniques.

In the new year, personnel officers will have to draw up local regulations in a new way. Special conditions for document management will be offered to so-called micro-enterprises.

Transition to electronic sick leave

Obtaining a certificate of incapacity for work, certifying it with the signature and seal of a doctor is often a problem. The specificity of service in polyclinics is such that queues are common here. The patient has to spend a lot of time to get an appointment with a specialist, and after an illness close the sick leave. Disability sheets are often provided at the place of work with a delay.

Lawmakers see the solution to the problem in the introduction of a system for issuing electronic sick leave. The transition to it is planned to be carried out gradually. The pilot project will be launched in 2017. The certificates of incapacity for work, duly executed, certified by the electronic signature of a medical specialist, will have legal force, as well as paper standard documents.

Doing business without the approval of local regulatory documents

The approval procedure for local regulatory documents will become optional from 2017. True, only small businesses, individual entrepreneurs, and micro-enterprises will be able to take advantage of the privilege. They will no longer be required to formulate labor regulations, shift work schedules, etc.

Simplification of the workflow is intended to reduce the burden on HR departments. However, it should be borne in mind that mandatory documents must now be drawn up at the enterprise according to the new rules. In particular, the form of standard employment contracts will change significantly. The documents will be supplemented with information previously contained in local regulations.

Noteworthy are other changes concerning the relationship between the employer and the employee, directly or indirectly. So, specialists of personnel services and heads of organizations where foreign specialists work are recommended to warn employees about the need to issue a Russian-style driver's license. The use of foreign documents from 2017 will be banned. In order to avoid problems with the law, in order to minimize the risks of project downtime (especially those related to cargo transportation), it is recommended to take care of issuing licenses for drivers in advance.

CHANGE # 1:

A new document has appeared, which is presented by a person applying for work when concluding an employment contract. Candidates for work related to activities that are not allowed to be carried out by persons brought to administrative responsibility for drug use, present a certificate. The certificate must indicate whether or not the bearer is subject to administrative punishment for the consumption of narcotic drugs or psychotropic substances without a doctor's prescription or new potentially dangerous psychoactive substances.

1. It is necessary to check if the organization has any positions in which the employment of employees is prohibited by law during the period of administrative punishment for drug use.

2. If there are such positions, it is necessary to request a certificate from the candidate for work before concluding an employment contract with him.

The candidate must obtain a certificate from the regional department of the Ministry of Internal Affairs. The procedure for issuing a certificate and its form were approved by order of the Ministry of Internal Affairs of Russia dated October 24, 2016 No. 665.

Date of application of the change: 01.01.2017.

CHANGE # 2:

1. There are guarantees for employees who are sent by the employer for an independent assessment of their qualifications. For an employee who, while away from work, undergoes an independent assessment of qualifications for compliance with the provisions of the professional standard, the position and average salary at the main place of work are retained. If the independent assessment takes place in a different location, the employee is paid travel expenses.

2. There is a new requirement that the employer pays for the independent assessment.

What you need to do to apply the changes:

1. The employer pays for an independent assessment of qualifications if he sends an employee to it on his own initiative.

2. An order is issued to preserve the employee's place of work and average earnings for the period of an independent assessment of qualifications.

3. If an employee undergoes an independent qualification assessment in another locality, he will be reimbursed for expenses:

For travel;

Residential rental;

Daily allowance;

Other expenses that the employee has incurred with the permission or knowledge of the employer.

Date of application of the change: 01.01.2017.

CHANGE # 3:

1. The employer has the right to determine the need to send employees for an independent assessment of qualifications.

2. It is stipulated that it is possible to send an employee for an independent assessment of qualifications only with his written consent and on the conditions determined by the collective agreement or labor agreement.

3. New obligations of the employer: to approve the list of required professions and specialties for sending employees to undergo an independent qualification assessment; provide employees, aimed at an independent assessment of qualifications, guarantees provided by law, collective agreement, local regulations and employment contracts.

What you need to do to apply the changes:

1. A list of necessary professions and specialties for sending employees to undergo an independent qualification assessment, taking into account the opinion of the representative body of the organization's employees, is approved.

2. Changes are made to the collective agreement, local regulations. The new regulations prescribe the procedure and conditions for sending employees to an independent assessment of qualifications, guarantees that employees can count on.

3. The qualifications of workers are assessed for compliance with professional standards based on their education documents and work experience.

4. A decision is made which of the employees should be sent for an independent assessment of qualifications.

Date of application of the change: 01.01.2017.

CHANGE # 4:

It is stipulated that employees have the right to undergo an independent qualification assessment.

What you need to do to apply the changes:

It is necessary to clarify with employees about passing an independent qualification assessment. Additional agreements to employment contracts are concluded with those who have given written consent.

Date of application of the change: 01.01.2017.

CHANGE # 5:

1. The features of labor relations for employers - small businesses, which are classified as micro-enterprises, have been determined.

2. It is stipulated that if the employer has ceased to be a micro-enterprise, then no later than four months from the date of making changes to the register, he must begin to apply the general norms of the Labor Code to regulate labor relations.

What you need to do to apply the changes:

The rules of the new Chapter 48.1 of the Labor Code apply if the organization is a micro-enterprise and is included in the unified register of small and medium-sized businesses. The criteria are specified in the Federal Law of July 24, 2007 No. 209-FZ "On the development of small and medium-sized businesses in the Russian Federation."

Date of application of the change: 01.01.2017.

CHANGE # 6:

It is stipulated that a micro-enterprise has the right not to approve local regulations. If there are no local acts, it is necessary to include in labor contracts with employees those conditions that should be regulated by local acts.

What you need to do to apply the changes:

Employment contracts in micro-enterprises are concluded on the basis of a standard form of an employment contract, which was approved by the Government by Resolution No. 858 of August 27, 2016. It is recommended that an employment contract include all conditions that should be regulated by local acts, if they are not in the organization.

Date of application of the change: 01.01.2017.

CHANGE # 7:

It was established that in a credit institution, individual employees cease to receive incentive payments if a plan for the Bank of Russia participation in bankruptcy prevention measures is approved. The bank should stop paying incentive payments: additional payments and incentive payments, bonuses and other incentive payments. The employees who are not paid incentives include: the head, his deputies, the chief accountant, his deputy, the head and chief accountant of the bank branch, members of the bank's board of directors.

What you need to do to apply the changes:

This provision applies if a plan for the Bank of Russia participation in bankruptcy prevention measures has been approved in relation to a credit institution. From the moment of approval of the Plan, incentive payments to employees listed in Part 4 of Art. 349.4 TC.

Date of application of the change: 16.06.2017.

CHANGE # 8:

It has been established that it is possible to terminate labor contracts for the loss of confidence with certain categories of employees if they use foreign financial instruments.

Foreign financial instruments:

1) securities and related financial instruments of non-residents or foreign structures without the formation of a legal entity, which have been assigned an international security identification code;

2) participatory interests, shares in the authorized capital of organizations, the place of registration or location of which is a foreign state, as well as in the property of foreign structures, not defined as securities and financial instruments referred to them;

3) contracts that are derivative financial instruments, if at least one of the parties to such an agreement is a non-resident or a foreign structure;

4) trust management of property established in accordance with the legislation of a foreign state;

5) loan agreements, if at least one of the parties to such an agreement is a non-resident or a foreign structure;

6) loan agreements concluded with foreign banks or other foreign credit institutions located outside the territory of the Russian Federation.

What you need to do to apply the changes:

The ban on the use of foreign financial instruments has been established for individual employees of state corporations, public companies or state-owned companies, as well as employees of the Pension Fund of the Russian Federation, FSS, MHIF, other organizations created by the Russian Federation on the basis of federal laws, organizations created to fulfill the tasks assigned to federal state bodies ... In these organizations, employment contracts are terminated in accordance with clause 7.1 of Part 1 of Art. 81 of the Labor Code with an employee who owns or uses foreign financial instruments, if this gives rise to a loss of confidence in the employee on the part of the employer.

Date of application of the change: 28.06.2017.

CHANGE # 9:

Clarified that part-time work is:

Part-time full-time work;

Part-time work with a part-time work week;

Full-time and part-time work.

The employee and employer, when agreeing on part-time work, can divide the working day into parts. The parties can set part-time working hours, both without a time limit, and for any period that they agree on.

What you need to do to apply the changes:

1. In employment contracts or additional agreements to them on the establishment of part-time work for an employee, the following shall be indicated:

Length of working days and working week;

Working hours and rest hours: working days per week, start and end times of work, breaks in work, the condition for dividing the working day into parts;

The term for which part-time work is established.

2. By agreement with the employee, the employer can change the condition of part-time work, which was agreed upon before the amendment of the Labor Code.

Date of application of the change: 29.06.2017.

CHANGE # 10:

It has been clarified that in cases where the employer is obliged to establish part-time working hours at the request of the employee, this should be done for a period convenient for the employee, but not more than for the period of the existence of circumstances in connection with which the law obliges the employer to comply with the employee's request. The employer sets the working hours and rest hours in accordance with the wishes of the employee and taking into account the conditions of the organization.

What you need to do to apply the changes:

1. The employer, as before, is obliged to establish part-time work at the request of:

A pregnant woman;

One of the parents, guardian, trustee with a child under the age of 14;

One of the parents, guardian, trustee who has a disabled child under the age of 18;

A person caring for a sick family member in accordance with a medical report.

2. An employment contract or a supplementary agreement to it shall indicate:

Circumstances in connection with which the employee was established part-time work;

The period during which he will work part-time;

Working hours and rest hours, which the employer agreed with the employee, taking into account his wishes and the interests of the organization.

3. If the organization employs employees for whom part-time work at their request is established without a time limit, it is recommended to conclude additional agreements with them, which prescribe the period of validity of this condition.

Date of application of the change: 29.06.2017.

CHANGE # 11:

A rule has been introduced according to which it is possible to establish irregular working hours for part-time workers. For workers who work part-time, irregular working hours can only be established if they are working full-time and part-time.

What you need to do to apply the changes:

1. When a non-standardized working day is established for an employee, it is necessary to clarify that he works full-time or full-time with a part-time work week.

2. When an employee is assigned part-time working hours, it is necessary to clarify whether he does not work in the regime of irregular working hours. If this is the case, then you can set an incomplete week, the working day should remain the full duration.

3. If the organization employs workers for whom an irregular regime is established for part-time work, it is necessary to bring the terms of their employment contracts in accordance with the law.

Option 1. Irregular working hours must be canceled. The employee is granted additional leave, which he earned for the period until June 29, 2017. After this date, the employee will not be involved in irregular working hours. He is not entitled to leave.

Option 2. The mode of work on a part-time basis is changing - the employee is introduced to a full working day with a part-time working week (by agreement of the parties). In this case, the employer will be able to attract a full-time employee to work on irregular working hours.

Option 3. The employee is canceled part-time work. In this case, the employer will be able to attract him to work in the regime of irregular working hours.

Date of application of the change: 29.06.2017.

CHANGE # 12:

A rule has been introduced to pay overtime work on weekends and public holidays. Such work must be paid in an increased amount or compensated for with other rest time and not taken into account in the billing period, when the number of hours of overtime work that must be paid in an increased amount is calculated.

What you need to do to apply the changes:

1. Overtime work on a day off or a holiday is paid for the first two hours of work not less than one and a half amount, for the next hours - not less than double the amount.

2. Overtime work on a weekend or holiday shall be compensated for with other rest time, but not less than the time worked overtime, if the employee makes this request.

3. When, at the end of the billing period, the number of overtime hours worked by an employee is counted, which is paid in an increased amount, the hours that he worked on a day off or a holiday are not counted.

Date of application of the change: 29.06.2017.

CHANGE # 13:

A rule has been introduced to pay for hours of work on weekends and non-working holidays. The increased amount is paid for the hours that the employee actually worked on a weekend or a non-working holiday. If a part of the work shift falls on a weekend or holiday, then the hours worked from 0 hours to 24 hours on that day are paid in an increased amount.

What you need to do to apply the changes:

Each hour of work from 0 o'clock to 24 o'clock on a weekend or holiday is paid at least double:

To the pieceworker - not less than double piece rates;

An employee whose labor you pay at hourly wage rates - in the amount of at least double the hourly wage rate;

To an employee who receives a salary, if he worked on a weekend or holiday within the monthly norm of working time - in the amount of at least an hourly rate or part of the salary per hour of work in excess of the salary;

To an employee who receives a salary, if he worked on a weekend or holiday in excess of the monthly norm of working time - in the amount of at least double the hourly rate or part of the salary per hour of work in excess of the salary.

Date of application of the change: 29.06.2017.

CHANGE # 14:

It is stipulated that 15-year-old citizens who left school or were expelled from it and continue to receive general education in a different form of education can work. They can only do light work that does not harm their health and does not interfere with the learning process. It has been clarified that in order to conclude an employment contract with a 14-year-old citizen, the written consent of one of the parents, the trustee and the guardianship and guardianship authority is required.

What you need to do to apply the changes:

Without additional documents and permits, you can conclude employment contracts with citizens who have reached the age of 16.

1. With citizens who have reached the age of 15, labor contracts are concluded to perform light work that does not harm their health. When the working hours and rest hours are established, it is necessary to take into account the curriculum and educational program according to which the specified employee receives general education. Work should not be detrimental to learning.

2. In order to conclude an employment contract with a citizen who has reached the age of 14, who is receiving or has received a general education, it is necessary to obtain the written consent of one of his parents, guardian and guardianship authority

Date of application of the change: 12.07.2017.

CHANGE # 15:

The working week of employees under the age of 18 who receive general education or secondary vocational education and combine work with study has been clarified.

What you need to do to apply the changes:

Minor workers who receive general education or secondary vocational education and combine work with study are set the standard working hours per week no more than:

12 hours - for employees under 16;

17.5 hours - for employees from 16 to 18 years old.

Date of application of the change: 12.07.2017.

CHANGE # 16:

The length of the working day has been introduced for employees under the age of 18, including those who receive general education or secondary vocational education and work during vacations.

What you need to do to apply the changes:

Minors are assigned a working day no more than:

2.5 hours - for employees from 14 to 16 years old who work during the school year;

4 hours - for employees from 14 to 15 years old, including those who work during vacations, and for employees from 16 to 18 years old, who work during the school year;

5 hours - for employees from 15 to 16 years old, including those who work during vacations;

7 hours - for employees from 17 to 18 years old, including those who work during vacations.

Date of application of the change: 12.07.2017.

CHANGE # 17:

A new obligation for the employer has been introduced: to enter information about an employee who was dismissed for loss of confidence in accordance with clause 7.1 of part 1 of Art. 81 TC, in the register. The employer must include information about the dismissal of an employee due to a loss of confidence for committing a corruption offense in the register of persons dismissed with a loss of confidence (Article 15 of the Federal Law of December 25, 2008 No. 273-FZ "On Combating Corruption").

What you need to do to apply the changes:

Information about employees dismissed for loss of trust for a corruption offense is entered into the register, which will be posted in the state information system in the field of civil service on the Internet.

In connection with the emergence of new regulatory legal acts in the Russian Federation, it has undergone changes.

Changes in the Labor Code from 01.01.2017

About independent qualification assessment

From 01.01.2017 a completely new one comes into force. Federal Law of 03.07.2016 No. 238-FZ " » ... Simultaneously with this fact, the Labor Code of the Russian Federation establishes guarantees and compensation for employees sent by the employer to undergo an independent qualification assessment (). In the event that a person is sent to the specified grade with a break from work, his place of work, position, and also the average salary will be retained. If an employee leaves for another locality, then he will be paid the travel expenses (just as in the case of sending a person on a business trip).

The Labor Code of the Russian Federation states that payment for passing an independent assessment is carried out at the expense of the employer (if it is he who sends it).

In addition to the guarantees established by labor legislation, the employer must provide the employee with guarantees established by other regulatory legal acts containing labor law norms, collective agreements, agreements, local regulations, labor contracts ().

Reflected the rights and obligations of the employer in the direction of persons to pass the specified qualification assessment (). In particular, the need for a referral is determined by the employer, and it is he who determines the list of necessary professions and specialties for referring an employee to undergo an assessment, taking into account the opinion of the representative body of employees in the manner prescribed for the adoption of local regulations. The procedure and conditions for referral to undergo an assessment are determined by the collective agreement, agreements, labor contract, but the written consent of the employee must be required.

To pass an independent assessment of qualifications, an agreement is concluded between the employee and the employer.

The list of documents presented when concluding an employment contract () will be supplemented with a certificate of whether or not a person is subject to administrative punishment for the consumption of narcotic drugs or psychotropic substances without a doctor's prescription or new potentially dangerous psychoactive substances. Such a certificate is issued in the manner and in the form established by the Ministry of Internal Affairs of the Russian Federation. This certificate must be provided only when applying for a job related to activities that are not permitted for persons subjected to administrative punishment (before the end of the period during which they are considered subject to such punishment):

- for the consumption of drugs;

- for the consumption of psychotropic substances without a doctor's prescription;

- for the consumption of new potentially dangerous psychoactive substances.

The types of this activity are determined by federal laws. For example, such persons are not allowed to work on the ship in accordance with () and ().

Chapter 48.1 of the Labor Code of the Russian Federation

From 01.01.17 a new chapter is introduced in the Labor Code of the Russian Federation -. It reflects the features of labor regulation of persons working for employers - small businesses that are classified as microenterprises. Which organizations belong to microenterprises is indicated in h. 3 tbsp. 4 of the Federal Law of 24.07.2007 No. 209-FZ "On the development of small and medium-sized businesses in the Russian Federation".

Such an employer has the right not to adopt, in whole or in part, local regulations containing the following norms:

- internal labor regulations;

- regulation on remuneration;

- provision on bonuses;

- shift schedule;

- other.

But in this case, the employer must include these conditions in labor contracts with employees (). These contracts are concluded according to the standard form approved by Decree of the Government of the Russian Federation of August 27, 2016 No. 858 "On the standard form of an employment contract concluded between an employee and an employer - a small business entity that belongs to microenterprises."

Since some legal acts concerning military service in the military prosecutor's office and military investigative bodies of the Investigative Committee of the Russian Federation are being changed, minor amendments have been made to.

The traditional increase in the minimum wage on January 1, 2017 did not happen. But from July 1, 2017, the minimum wage will increase by 300 rubles. - from 7 500 rubles. up to RUB 7 800

The change in the minimum wage will not affect the amount of insurance premiums, since at the legislative level only one recalculation is provided during a calendar year.

Electronic sick leave takes effect

Temporary disability sheets are being replaced by electronic sick leave, although they will not immediately replace paper forms. The process will take place gradually.

It is assumed that electronic sick leave will be issued to patients with their written consent and certified with an enhanced qualified electronic signature.

Benefits of electronic sick leave:

- interested parties will be able to track information about issued sick leave in an automated system that will be under the control of the FSS of Russia;

- employers will be provided with data on hospital workers employed by them; the FSS and medical institutions will also have access to the database;

- disability certificates are almost impossible to counterfeit;

- the risk of being fined for accepting the payment of sheets that do not meet the requirements of the FSS, for employers is reduced to zero.

In the near future, the Ministry of Health will decide on the form and sample for filling out an electronic sick leave.

Personal data will have to be processed with special care due to a significant increase in fines

We have previously written that the law expands the list of offenses in the field of personal data protection. Now there will be seven of them, for each violation there will be a fine. Moreover, the maximum monetary punishment is provided for the processing of personal data without the consent of their subject - up to 75,000 rubles.

Adjustments for part-time work, overtime pay, and work on weekends and holidays

The basis is the Federal Law of June 18, 2017 No. 125-FZ (amends Articles 93, 101, 108, 152 and 153 of the Labor Code)

It is important for employers to know that the law:

- Sets the possibility of reducing the duration of daily work (shift) by a certain number of working hours while reducing the number of working days per week.

- Explains when an employee working on a part-time basis can be assigned an irregular working day: only if by agreement of the parties a part-time working week is established, but with a full working day (shift).

- Clarifies that if the duration of daily work (shift) established for an employee does not exceed four hours, he may not be provided with a break for rest and meals.

- Specifies the procedure for remuneration for overtime work: when calculating overtime hours, work on weekends and non-working holidays, performed in excess of the working time norm, is not taken into account.

- Clarifies that part-time work can be set both without a time limit and for any period agreed by the parties. At the same time, the division of the working day into parts is also allowed.

- Gives an understanding of the payment procedure on weekends and non-working holidays. Increased payment is made to all employees for hours actually worked on a weekend or non-working holiday. If a part of the working day (shift) falls on a day off or a non-working holiday, the hours actually worked on that day (from 0 hours to 24 hours) are paid in an increased amount.

- Indicates that in cases where the employer is obliged, at the request of the employee, to establish part-time work, it should be set at a time convenient for the employee, but not more than for the period of the relevant circumstances. In this case, the working hours and rest hours are determined in accordance with the wishes of the employee, taking into account the conditions of production (work) at the given employer.

- Introduces the obligation to establish part-time work at the request of a pregnant woman, one of the parents (guardian, guardian) of a child under the age of 14 (a disabled child under the age of 18), as well as a person caring for a sick family member. In this case, part-time working hours are established for no more than the period of the specified circumstances.

13 constituent entities of the Russian Federation will join the FSS pilot project "Direct payments"

The project already involves 20 regions, and it should be completed in 2019.

According to the new rules, the following will have to work: the Republic of Adygea, the Republic of Altai, the Republic of Buryatia, the Republic of Kalmykia, the Altai Territory, the Primorsky Territory, the Amur Region, the Vologda Region, the Magadan Region, the Omsk Region, the Oryol Region, the Tomsk Region, the Jewish Autonomous Region.

According to the innovations, policyholders must send all documents for temporary disability benefits directly to the FSS. Employers will still have to pay their employees for the first three days of illness, with the exception of cases when the benefit is paid in full from the budget.

The Direct Payments project frees policyholders from the functions of calculating benefits. For insured citizens, he ensures the correctness of the calculation of benefits, frees them from dependence on the employer and minimizes conflict situations with him, provides an independent choice of the method of receiving benefits - to a bank account or by postal order.

For the FSS, this is the ability to control all paid sick leave certificates, the transition to an electronic sick leave certificate, a reduction in insurance fraud cases, and cost optimization.

All the necessary information on the Direct Payments project (regulatory documents, brochures, memos, etc.) can be found