Hourly minimum wage for hourly wages. How to calculate the hourly rate

Currently, wages can be different forms. In the West, and more recently in Russia, hourly wages are becoming more and more popular. However, the question arises: is such payment optimal and what is more in it, advantages or disadvantages? Let's try to find out.

Many companies today are dominated by a tariff-free payment system, which means that wage of an employee does not depend on his achievements, but on the achievements of the entire company and on the volume of the salary fund. The tariff system, on the contrary, implies taking into account the results of each individual employee, the amount of work performed by him and the amount of time he worked. At the same time, the tariff system of payment includes time-based, piecework and mixed forms.

Hourly is a case of a time-based form and is used when it is difficult to normalize some specific work. Of course, it is possible to count the amount of some kind of "handicraft" made per hour, but at the same time, it is almost impossible to estimate the hourly work of a teacher or a doctor.

Such hourly pay can be simple or with the addition of a bonus. Simple payment implies a certain cost per hour of work. In this case, the result does not play a very important role, and quality is a secondary task. If quality and volume are taken into account, a premium can be added to the hourly rate, the amount of which is determined in advance. Hourly wages may be accompanied by a certain standardized task. In this case, the employee receives an additional payment for the accurate performance of the task.

As a rule, the tariff rate is calculated taking into account the established by law. In addition, the number of hours spent at work also affects the size of the rate. Usually exceeds the minimum, since the complexity of the work, the skills of the employee and other points are taken into account. Note that the tariff rate should not be below the minimum.

Hourly pay is considered very beneficial for the employer for a number of reasons. The thing is that the working hour is evaluated equally and has a certain duration. This fact allows you to calculate the amount of money earned as accurately as possible if the employee was suddenly absent from the workplace or absent for an hour or two. In addition, such payment allows the manager to clearly pay for the work of people who work part-time or have a special flexible schedule. “Hourly work” saves a lot of money, as employees receive only for the time they actually spent at work.

Naturally, hourly wages have their drawbacks. The first is the complexity of the calculation, strict accounting of the time of work of each employee. The second is the inefficiency of payment without bonuses. The third is the need to hire a controller who will monitor the work and who also needs to be paid something.

Regarding employees and benefits hourly pay labor for them, there are several points of view. If a person wants to find a job with or part-time, payment by the hour will undoubtedly suit him. Often there are hourly wages for teachers whose working day cannot be accurately standardized. Usually, nannies, cleaners, waiters, tutors, cooks, bartenders, couriers get paid hourly, as the workload is not uniform.

However, there are many unscrupulous employers who set the bar too high for employees and give a large amount of work per hour. As they say, you don’t have to do it once, so you need to deal with the advantages and disadvantages on the spot. The decision on whether hourly pay is right for you should depend on the type of occupation, work schedule and policies of a particular employer in his enterprise.

Any accountant needs to know how to calculate the hourly rate for employees of an enterprise who are paid a rate or salary based on hours of work. It can be withdrawn for a certain accounting period. So the hourly rate is the money earned in one hour. The daily wage rate is the amount of wages per day of work.

This payment system is more often used in industries where technological process has a continuous cycle, and the introduction of shift work is necessary. The workers of each shift go out to work according to their own schedule for a set number of hours, therefore, when it is advisable to apply hourly rate. The tariff rate is an invariable part of remuneration for work. It cannot be reduced by the decision of the management for any violations. Additionally, they stimulate employees to achieve high results with the help of bonuses, additional payments, allowances, compensations.

The need for summary accounting

The Labor Code establishes that a person must work in production for no more than 40 hours a week. But at shift schedule work to meet such a requirement is very difficult. One week may include more working hours, another less. Then there is processing, which is a violation of the law, since it is allowed to work more than the established time only in exceptional cases to eliminate the consequences of disasters.

The head of the enterprise in special cases may involve additional work employees:

- to complete certain types of work not completed during business hours;

- for emergency repairs of equipment necessary for the work of the rest of the team;

- in the absence of a shift at work, when it is impossible to stop work.

In order to formalize the processing, you need to prepare an order, obtain the written consent of the employee himself, and coordinate the issue with the trade union. Next, you should keep track of the processing time and pay for it separately. Otherwise, the head of the enterprise faces big troubles in the form of accusations of non-compliance labor law and penalties. To engage in such work on a weekly basis, it is necessary to increase the staff of the administrative apparatus, which leads to unplanned costs.

To avoid violating the law, the summed accounting of hours worked, summarized in one period, is applied. In this case, the time worked is considered a cumulative total in one accounting period.

An example of such a period is a calendar month. Throughout it, the deviation of the employee's work time from the norm is controlled. If in one week more than 40 hours of work are obtained, then in another it is necessary to provide for less work. In order to meet the established standard for the accounting period as a whole.

Read also The level of average wages in Russia

Options for determining the rate

There are two ways to calculate the hourly rate. Which one to use for work, enterprises can decide on their own, taking into account the advantages and disadvantages of each method. In this case, you need to build on the period selected for summing up working hours.

Important! Before calculating the salary by the hour, the accountant must find out what period is accepted for summing up the working time in normative documents enterprises. Usually this issue is reflected in the regulation on remuneration and the collective agreement. And in employment contract concluded with a citizen when applying for a job, the tariff rate for calculating salaries should be indicated.

An example of determining the indicator can be done in two versions for different accounting periods. The calculation of the hourly rate separately for the month and year will clearly show which method is better to use in enterprise accounting.

monthly calculation

Using this method, the rate is calculated for each month separately. To determine its size, you need to divide the salary (monthly rate) established by the employee by the number of working days according to the standard for a particular month. The standard can be viewed in the production calendar. Consider an example where the salary of an employee is 32,000 rubles. According to the norm for May 2019, 160 hours are approved. The hourly rate will be 200 rubles. If you make the same calculation for the month of March, the result will be different. The March norm is 175 hours, the hourly tariff rate is 182.86 rubles. With this method of payment, in the case when all the days are worked out according to the approved schedule, a monthly salary will be accrued in the amount of the salary, despite the different number of working days. But if you need to pay for processing, then with the same hours in different months of the year, it will add up to different amounts.

Annual calculation

Accounting for total hours of work in a year may seem more complicated. For this method of calculation, it is necessary to determine the average monthly norm of hours by dividing the annual norm of working hours by 12 months. For 2019, the working time norm is set at 1,973 hours, therefore, the average monthly rate will be 164.42 hours. The hourly rate can be calculated by dividing the salary (monthly rate) by the average monthly rate of hours. To make the example more clear, we use the same salary of 32,000 rubles, at which the tariff rate per hour will be 194.62 rubles. This calculated figure will remain constant throughout the year and will apply to any co-payments and compensations. By this method, hourly wages are more accurately determined. Since it does not change during the year, the calculation of the amounts of additional payments and compensations is more understandable to the workers themselves. They do not have claims and suspicions about incorrectly calculated salaries.

The calculation of wages at any commercial or state enterprise takes place in accordance with the legislative acts in force in this moment time. Its amount depends on the official salary prescribed in the employment contract, the hours worked during a certain period and other details. The amount due for payment is calculated by the accountant on the basis of a number of documents.

What is included in the calculation?

To date, two types of payment are most often practiced:

- Time . The first provides for a salary determined by the contract for the hours worked - an hour, a day, a month. Often a monthly rate is practiced. In this case, the total amount depends on the time worked during a certain period of time. It is mainly used in the calculation of salaries for employees who do not depend on the amount of the created product - accountants, teachers, managers.

- piecework . Depends on the amount of product created for a certain period. Often used in factories. It has several subspecies, which we will consider a little later.

Thus, time wages provide that the head of the enterprise or other official is required to maintain and fill out a time sheet. It is issued in the form No. T-13 and is filled out daily.

It should note:

- the number of working hours worked during the day;

- exits "at night" - from 22:00 to 6:00;

- out of hours (weekends, holidays);

- omissions due to various circumstances.

Piecework payment provides for the presence of a route map or an order for a certain amount of work. In addition, the following are taken into account: sick leave, orders for bonuses, orders for the issuance of financial assistance.

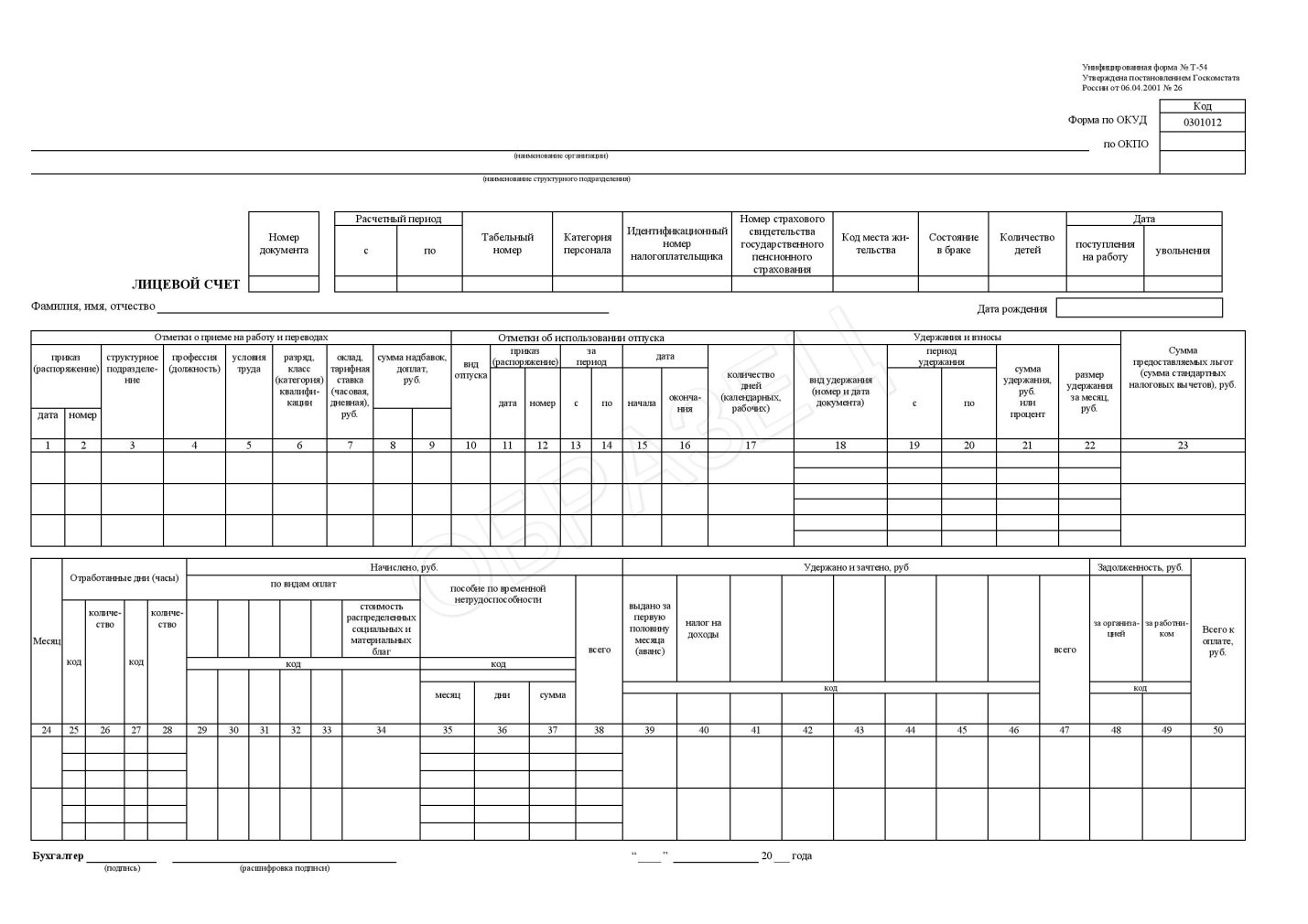

After hiring, each accountant must keep an analytical record of wages and record it in the form No. T-54. This is the so-called personal account of the employee. The data specified in it will be taken into account when calculating hospital payments, vacation and other types of benefits.

You can find out how vacation pay is calculated.

Calculation formula and examples

Hourly pay provides for remuneration according to the time worked and the salary of the employee.

It is calculated as follows:

For monthly salary:

ZP \u003d O * CODE / KD, where

- O - fixed monthly salary;

- CODE - days worked;

- CD is the number of days in a month.

For hourly/daily fixed salary:

ZP \u003d KOV * O, where

- ZP - wages excluding taxes;

- KOV - the amount of hours worked;

- O - salary per unit of time.

Consider an example:

Tatyana Ivanovna has a monthly salary of 15,000 rubles. There were 21 working days in a month, but since she took a vacation at her own expense, she worked only 15 days. In this regard, she will be paid the following amount:

15,000*(15/21)=15,000*0.71= 10,714 rubles 30 kopecks.

Second example:

Oksana Viktorovna works with a daily salary of 670 rubles. This month she worked 19 days. Her salary will be:

670 * 19 \u003d 12,730 rubles.

As you can see, the formula for calculating wages for this type of payment is very simple.

Piecework payment - how to calculate?

With piecework wages, the amount of work performed is paid. At the same time, prices are taken into account in the ratio of the volume of work.

With piecework wages, wages are calculated according to the following formula:

ZP \u003d RI * CT, where

- RI - prices for the manufacture of one unit;

- CT - the number of products produced.

Consider the following example:

Ivan Ivanovich produced 100 engines in a month. The cost of one engine is 256 rubles. Thus, in a month he earned:

100 * 256 \u003d 25,600 rubles.

piece-progressive

It is worth considering separately such a type of payment as piecework-progressive, in which the price depends on the number of products produced for a certain period.

For example, if an employee produces 100 engines per month, then he receives 256 rubles for each. If it exceeds this norm, that is, it produces more than 100 engines per month, the cost of each engine produced in excess of the norm is already 300 rubles.

In this case, earnings for the first 100 engines and separately for subsequent ones are considered separately. The amounts received are cumulative.

For example:

Ivan Ivanovich made 105 engines. His earnings were:

(100*256)+(5*300)=25,600+1,500= 28,100 rubles.

Other payment systems and their calculation

Depending on the specifics of the work, payment can be:

- chord . Often used when paying for the work of the brigade. In this case, the salary of the brigade as a whole is calculated and issued to the foreman. The workers divide the amount received among themselves according to the agreement existing in their brigade.

- Payment based on bonuses or interest . A bonus or commission system is applied to employees on whom the company's revenue depends (see also). Quite often it is applied to sales consultants, managers. There is a constant, fixed rate and a percentage of sales.

- shift work . The shift method of work provides for payment according to the employment contract - that is, by the time or for the amount of work performed. In this case, interest surcharges may be charged for difficult conditions labor. For exits on non-working days, holidays, payment is calculated in the amount of at least one daily or hourly rate on top of the salary. In addition, an allowance is paid for the shift method of work from 30% to 75% of the monthly salary. The interest rate depends on the region in which the work takes place. For example, Ivan Petrovich works on a rotational basis. His monthly rate is 12,000 rubles, the allowance for work in this region is 50% of the salary (O). Thus, his salary will be 12,000 + 50% O \u003d 12,000 + 6,000 \u003d 18,000 rubles per month of work.

Payment for holidays and night shifts

When working in shifts, each shift is paid depending on the tariff rate of each shift. It is either established by an employment contract or calculated by an accountant.

At the same time, it should be borne in mind that weekends and holidays are paid at a higher rate - an increase in the rate by 20%. In addition, exits at night from 22:00 to 06:00 are also subject to a rate increase of 20% of the cost of an hour of work.

payroll taxes

When calculating wages, do not forget about taxes. Thus, the employer is obliged to pay 30% of the amount of calculated wages to the insurance premium fund.

In addition, employees are charged 13% of their wages in personal income tax. Let's take a look at how taxes are calculated.

First of all, the tax is charged on the entire amount of wages, except for cases in which there is a tax deduction. So, a tax deduction is calculated from the total amount of wages, and only then the tax rate is calculated on the resulting value.

The right to a tax deduction has a number of socially unprotected categories, the list of which is prescribed in article 218 of the Tax Code of the Russian Federation. These include:

- Veterans of the Great Patriotic War, invalids, whose activities were connected with nuclear power plants. The tax deduction is 3000 rubles.

- Disabled people, participants of the Second World War, military personnel - 500 rubles.

- Parents who are dependent on one or two children - 1,400 rubles.

- Parents who are dependent on three or more children - 3,000 rubles.

The last two categories are restricted. So, after the amount of wages received from the beginning of the calendar year reaches 280,000 rubles, the tax deduction is not applied until the beginning of the next calendar year.

Example:

Ivan Ivanovich's monthly salary was 14,000 rubles, since he worked for a full month. He received a disability while working at a nuclear power plant. Thus, his tax deduction will be 3,000 rubles.

The personal income tax is calculated for him as follows:

(14,000 - 3,000) * 0.13 = 1430 rubles. This is the amount that must be withheld when receiving wages.

Thus, he will receive in his hands: 14,000 - 1430 \u003d 12,570 rubles.

Second example:

Alla Petrovna is the mother of two minor children. Her salary is 26,000 per month. By December, the total amount of wages paid to her will be 286,000 rubles, therefore, no tax deduction will be applied to her.

Payment procedure and calculation of delays

According to all the same legislation, wages must be paid at least 2 times a month. Allocate an advance, which is issued in the middle of the month and the actual salary.

The advance payment averages from 40 to 50% of the total amount of payments, at the end of the month the rest of the payments are issued. Usually this is the last day of the month, if it falls on a weekend - the last working day of the month. In case of untimely calculation of wages, the employer is obliged to pay a fine.

In addition, compensation is provided for the employee, which is issued at his request and amounts to 1/300 of the rate for each day of delay.

Video: Simple payroll

Familiarize yourself with the basic nuances of calculating and calculating wages. An experienced accountant will tell you how to correctly calculate wages, depending on the wage system you choose.

The calculation of wages is made by an accountant on the basis of a number of documents. There are two main systems of remuneration: piecework and time. The most popular is the time-based wage system - it is quite simple and is used in most industries.

State Duma deputies refused to transfer employees of Russian organizations to hourly wages with a minimum rate of 100 rubles per hour. This initiative has been discussed for more than 10 years, but officials still have doubts about the need for its implementation. Therefore, the State Duma rejected the relevant bill in the plenary session.

What happened?

State Duma deputies voted against the adoption of bill No. 393-7 on the minimum hourly wage, the author of which is the Just Russia faction. The initiative was part of integrated system social support of the population, developed by parliamentarians.

100 rubles per hour: a lot or a little

The bill proposed to abolish operating system calculation of the minimum wage per month and switch to hourly wages. Each worker was to be paid 100 rubles per hour of work. The deputies proposed to use this indicator exclusively for calculating wages, and for other purposes, deputies continue to use the subsistence minimum for the able-bodied population in the whole of the Russian Federation.

According to the idea of the parliamentarians, workers should not receive less than 100 rubles per hour. And every year the hourly pay was supposed to grow, taking into account the projected inflation, representatives of the Just Russia party insisted. However, even taking into account the last planned increase in the minimum wage (already supported by the deputies in the first reading), the hourly wage significantly exceeds its size. So, from May 1, 2018, the minimum wage should be 11,163 rubles (now 9,489 rubles), and at an hourly rate of 100 rubles, the monthly minimum wage would be about 16,800 rubles. After all, for one day of work with an 8-hour shift, the employee would receive at least 800 rubles. And this is almost 1.5 times more than the minimum wage proposed by the President of Russia. Therefore, the transition to hourly pay from this side is beneficial to the population, but not beneficial to officials and employers.

However, it should be noted that for the first time about changing the rules for calculating the minimum wage officials almost 12 years ago. Legislative ones were periodically introduced to the State Duma, but they were rejected or postponed until "better times". But the most interesting thing is that all these years it was proposed to pay 100 rubles per hour of work. Life over the past 10 years has changed dramatically, but the cost of work, even within the minimum wage, is still refused to be increased.

Hourly pay: pros and cons

The government admits that hourly wages are not new. This mechanism works in many European countries, therefore, most likely, it will appear in Russia. But so far officials cannot afford to abandon the existing system.

For example, the Minister of Finance Anton Siluanov, that hourly wages are very beneficial for business. Employers will have the opportunity not to overpay unemployed employees. At the same time, according to the minister, the minimum wage should not be raised sharply so as not to increase the burden on business. As for the rights of workers, with the transition to hourly pay, employers will no longer be able to increase the length of the working day if they do not pay for the additional time worked by the employee.

Minister of Labor and Social Protection Maxim Topilin does not support his colleague. According to him new system wages does not guarantee that the employer will not specifically reduce the number of working hours, while demanding increased productivity. It will not be possible to verify this fact, and citizens will actually find themselves in a situation where they either work a lot for less money, or do not work at all. And such a situation in the current crisis will only lead to an increase in the level of poverty in the country, analysts warn.

Under the hourly wage understand a special system for calculating wages. Its application is justified for certain categories of workers.

Dear readers! The article talks about typical ways solving legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

Today, most employers choose this system for its employees, as it allows you to pay funds only for the hours actually worked.

Concept, essence and features

The hourly wage system is one of the varieties of the time-based form of awarding remuneration for work.

It is used when it is difficult to normalize the work of an employee.

When calculating wages, not only the number of hours worked, but also the qualifications of the employee are taken into account. For example, it applies to teachers.

What it is?

There is no legal interpretation of the concept “hourly wage system” in the legislation. In practice, this term means a special way of calculating the wages of employees.

Hourly pay can be of different types:

- simple- when the cost of one hour is a fixed amount, which does not depend on the result achieved by the employee;

- with a normalized task- when an employee receives an additional payment for the performance of a task that was assigned to him.

What does it depend on?

The amount of payment will depend on the number of hours actually spent by the employee on the performance of the labor function.

This method is very convenient for part-time workers, as well as persons performing a labor function on a part-time basis or on a flexible schedule.

As we have already said, the employer can stimulate the employee by setting special tasks, the implementation of which is encouraged by an additional payment.

In what cases is it applied?

This system is applied when it is provided for in the agreement concluded between the employee and the employer.

Recently, this method has become very popular among entrepreneurs who hire employees. It is suitable for the following workers: teachers, tutors, nannies, bartenders, waiters, cleaners.

Hourly pay is ideal for part-time employees. It is suitable for employees whose workload varies on different working days.

Pros and cons

Advantages of the hourly payment system:

- for the employer- cost savings, when employees receive money only for the hours actually worked, the ability to track and monitor the effectiveness of working hours, the convenience of settlements with part-time workers;

- for workers- convenient for employees of certain professions, as it allows you to take into account their uneven workload.

Minuses:

- for employers- the complexity of the financial calculation of wages, the need to strictly control the amount of time worked by employees;

- for workers- the absence of bonuses and bonuses, the possibility of abuse by an unscrupulous employer who will set unrealistic amounts of work for one hour.

How is hourly wages implemented at the enterprise?

To implement hourly wages, it may be necessary to involve a special person who will keep records of the time worked by each of the employees.

The procedure for the application of this system can be established in a special local act, which is published by the head of the enterprise and operates within its boundaries.

An order is also issued, which directly reflects the size of tariff rates for certain types professions.

Application conditions

This remuneration regime can be used only when it is provided for in the employment contract with a specific employee.

If the enterprise has local documents (regulations, orders) that determine the procedure for using the hourly system, then the employee must be familiarized with them against signature.

Is there a minimum size?

There is currently no uniform minimum wage per hour. However, the introduction of such an indicator is already being actively discussed at the legislative level.

In what documents and how is it reflected?

Before applying the hourly wage system, it is necessary to fix this rule in the following documents:

- labor agreement;

- staffing;

- order.

Also, within the organization, a special document can be developed that establishes the procedure for calculating the amount of remuneration.

In the employment agreement, the condition for the application of such a system can be set out in a free form.

The enterprise may issue a separate order on the hourly wage system. In the staffing table, a reservation is made in the column "with a tariff rate (salary), etc."

Labor contract

How to make an hourly payment in the contract? It should indicate the use of hourly pay and the amount of the tariff rate.

If a district coefficient is applied in the region, then this should be indicated. It is not necessary to indicate the number of hours that the employee will have to work, as well as the length of the work week.

According to Labor Code RF 2019 its maximum is 40 hours. This rule applies to all employees.

An example of such an agreement:

Regulations on wages

The regulation on remuneration acts as a local document that is developed within the framework of one enterprise and is valid for all its employees.

All employees must be familiar with this document, only then it is valid.

The regulation details the procedure for calculating the length of the worked period, calculating wages, and bonuses.

staffing

The staffing table is a document that functions within the framework of one enterprise. It reflects information on the structure, number and composition of employees.

The staffing table has a certain form N T-3.

It is necessary to make an indication of the use of hourly payment in the column - “With a tariff rate (salary), etc.”.

Attention should be paid to the indication "ex.". It is it that allows us to include here the “hourly rate of _____ rubles / hour”. In the note, it is permissible to make a note - "Time-based wage system."

In the column that determines the total wage, you need to write the number that will be obtained by multiplying the hourly rate by the number of hours that an employee works on average per day.

Order

The employment order may also contain an indication of the use of hourly wages.

In this case, he needs to supplement this document with the column "with an hourly rate of ______ rubles / hour."

On the basis of what documents is it calculated?

Remuneration is carried out on the basis of a time sheet or other document that is used to record the time actually worked by an employee.

An order or an employment contract is also used, in which the value of the tariff rate is written.

The procedure for transferring to hourly pay and its introduction

Transfer to hourly pay is possible only with the consent of the employee.

In such a situation, an additional agreement is concluded to the employment contract. It is signed by both the employee and the employer. Also, the employee must be familiar with local acts that regulate new order payroll calculations.

Calculation

The calculation is made taking into account the hours worked, which is multiplied by the tariff rate. Special methods of counting may be established by local acts.

For example, it can be a complex bonus system depending on the results achieved and the overall performance of a particular employee.

Formulas

The specific calculation formula will be approved in the local act adopted at the enterprise.

For example, it might look like this:

salary \u003d Tch * Wh, where

- Tch - the tariff set for a particular employee;

- Hh - actual hours worked.

Examples

Here is an example of a calculation:

Ivanova A.P. works as a waitress. According to the employment contract, the tariff rate for her is 85 rubles per hour. In June, she actually worked - 160 hours.

Consequently, her salary will be: 160 * 85 = 13600 rubles.

How to calculate holiday pay?

Vacation pay is calculated according to general principle- based on the size of the average monthly earnings.

Nuances

Special points are related to the payment procedure, non-working holidays, etc. These issues are regulated by the norms of the current Labor Code of the Russian Federation.

You need to know that the decision of some points is left to the discretion of the parties. labor agreement. Such nuances are prescribed in the employment contract, local acts.

That is why the employee must carefully read all the documentation that will be presented to him.

In a budget institution